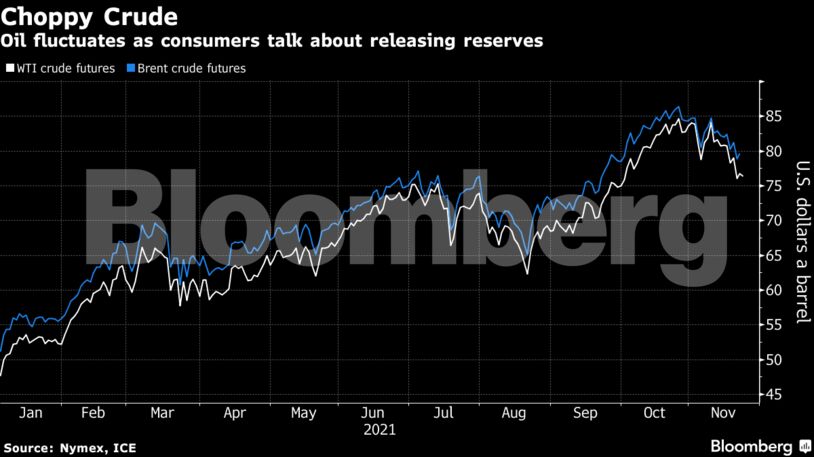

The rift between producers and consumers threatens to set up a fight for control of the global oil market. Crude’s rally has faltered over the past few weeks, in part due to speculation that consumers will release supplies from strategic reserves. A Covid-19 resurgence in the U.S. and Europe, meanwhile, is raising concerns about the outlook for demand.

The U.S. is considering a release of more than 35 million barrels over time, although the situation remains in flux and plans could change, according to a person familiar with the White House’s plans.

“This SPR release will be one for the history books,” said Keshav Lohiya, founder of analytics company Oilytics. “The general rule normally holds to do the opposite of what the government does in the markets, and we wonder if this SPR release will set the bottom for oil prices.”

| Prices |

|---|

|

The White House is also considering a ban on its crude exports to reduce oil prices, according to a lawmaker championing the move. It was only six years ago that Congress lifted a 40-year-old ban on U.S. exports, which have regularly surpassed 3 million barrels a day.

Any release from reserves could be bridging a gap to a period where oil market balances are expected to weaken. The International Energy Agency said last week that the end of the price rally could soon be in sight as production recovers. The United Arab Emirates said there was no need for OPEC+ to increase production any faster than planned, despite the consumer pressure.

“The comments from OPEC+ today suggest that the plan will not change,” said Emily Ashford, an analyst at Standard Chartered. “While that could mean no additional production, it could also mean that we won’t see a pausing of output increases at the December meeting.”

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Canada’s Advantage as the World’s Demand for Plastic Continues to Grow