Since then, researchers have raised questions about the credentials of money managers who claim they are marketing funds designed to address the climate crisis and social injustice.

A London-based nonprofit called InfluenceMap said more than half of climate-themed funds are failing to live up to the goals of the Paris Agreement. Christiana Figueres, former executive secretary of the United Nations Framework Convention on Climate Change, said the world’s sovereign wealth funds will be on the wrong side of history if they cling to strategies that don’t acknowledge how rapidly the planet is warming. Figueres didn’t accuse wealth funds of greenwashing, but she bemoaned what she said was the industry’s failure to embrace strategies that commit to a lower carbon footprint.

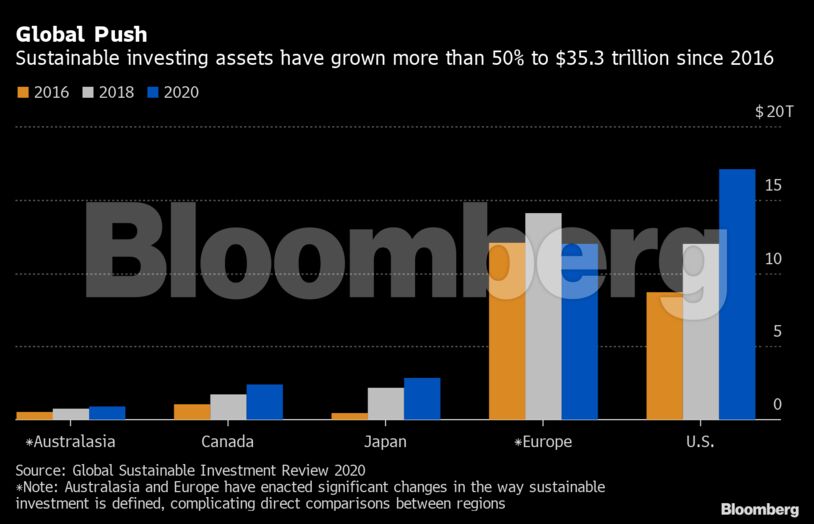

The timing of these comments is troubling for an industry that has ballooned to $35 trillion of assets, with many money managers betting that investors will keep pouring more money into funds marketed as adhering to the best environmental, social and governance principles.

Marketed being the key word. The reality, however, is quite different. InfluenceMap found that 55% of funds marketed as low carbon, fossil-fuel free and green energy exaggerated their environmental claims, and more than 70% of funds promising ESG goals fell short of their targets.

“As the number of ESG and climate-themed funds has exploded in recent years, so too have concerns among investors and regulators about greenwashing and transparency,” said Daan Van Acker, an analyst at InfluenceMap.

The SEC formed a task force in March aimed at investigating potential misconduct related to companies’ sustainability claims. Gary Gensler, who took over the agency in April, has said his staff is working on a rule to boost climate disclosures by stock issuers, and that the regulator remains focused on ESG issues.

In a recent report, the Global Sustainable Investment Alliance erased $2 trillion from the European market for sustainable investments after anti-greenwashing rules were introduced in March by the European Union.

The Sustainable Finance Disclosure Regulation, or SFDR, demands that fund managers evaluate and disclose the ESG features of their financial products. For ESG, there are now “light green” Article 8 funds, which are defined as those that actively promote environmental or social characteristics, and “dark green” Article 9 funds, which have sustainable investment as their main objective. Both groupings are subject to higher standards of disclosure under the SFDR.

There aren’t yet similar requirements in the U.S., so it’s uncertain how many true-green ESG funds there really are. At the end of 2020, sustainable assets totaled about $12 trillion (after GSIA’s decision) in Europe, compared with closer to $17 trillion in the U.S.

Given the shrinkage in Europe, the U.S. figure may see a similar reduction when more regulatory rigor is brought to bear.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Workers Must Be Part of the Energy Transition – Resource Works