Futures in New York increased 1.8% on Friday, rising in tandem with broader markets. Beijing tapped its giant reserves “to ease the pressure of rising raw material prices,” according to an announcement from the National Food and Strategic Reserves Administration. It didn’t give further details, but people familiar with the matter said the statement referred to millions of barrels of oil that were offered to domestic refineries in July.

Some analysts see the move as a precursor to ramping up purchases later to make up for depleted stockpiles. Releasing stocks “for the first time can be seen as bullish as it’s in preparation for the demand bump in 4Q,” analytics firm Oilytics said in a report. Inventories “will have to be eventually replaced so demand is just getting deferred,” it said.

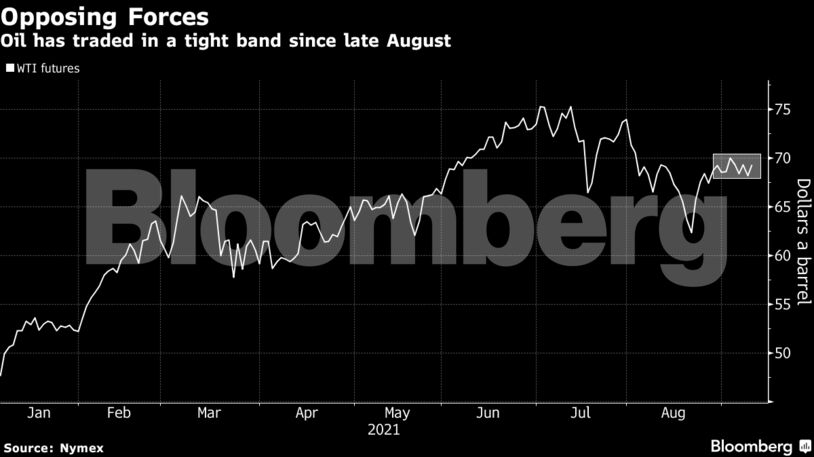

Despite the uncertainty caused by China’s move, crude in New York has traded in a $4 band since late August. The market has been pulled in different directions with the majority of Gulf of Mexico production still shut from Hurricane Ida and falling American stockpiles acting as bullish triggers, countered by the ever-present pandemic.

Friday’s price move reflects some “buying back following the overreaction yesterday, amid ongoing support from supply disruptions,” said Giovanni Staunovo, commodity analyst at UBS Group AG.

| Prices |

|---|

|

The Chinese agency also said a “normalized” rotation of crude oil in the state stockpiles is “an important way for the reserves to play its role in balancing the market,” indicating that it may continue to release barrels. It added that putting reserves on the market through open auctions “will better stabilize domestic market supply and demand.”

U.S. crude stockpiles fell last week as production tumbled the most on record due to disruptions caused by Hurricane Ida. Inventories shrank by 1.53 million barrels, according to the Energy Information Administration. The destructive storm led to a 1.5 million-barrel decline in daily crude output.

“Overall, the market looks stuck with the upside above $75 for Brent limited due to unease about its impact on global demand, while the prolonged Gulf outage adds some support,” said Ole Sloth Hansen, head of commodities strategy at Saxo Bank A/S.

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Canadians Should Decide What to do With Their Money – Not Politicians and Bureaucrats