Before the breakdown, the alliance appeared to have an agreement in principle to boost output 400,000 barrels a day each month from August to December to meet rising demand as economies recover from the pandemic. OPEC+ ministers will reconvene Friday as the dramatic turn of events leaves the market in limbo and tarnishes the cartel’s carefully reconstructed reputation after last year’s brutal Saudi Arabian-Russian price war.

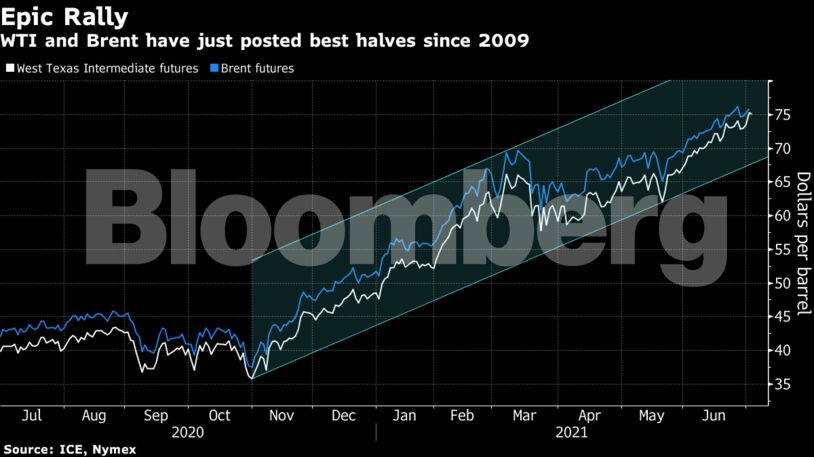

If OPEC+ can’t reach an agreement, it raises the possibility that crude will surge higher and add to mounting inflationary pressures in the global economy. Oil had just capped its best half since 2009 as the rapid rebound in energy demand in major economies outpaced the supply response. Citigroup Inc. said in a note before the standoff that it expects the market to remain in a deep deficit this quarter even, after accounting for a rise in output from OPEC+.

“Another OPEC+ implosion like last April is unlikely,” said Vandana Hari, founder of oil consultancy Vanda Insights. “They have worked too hard over the past year to ditch the pact in a huff at this stage. I expect the tentative deal between Saudi Arabia and Russia to go through, but some sort of concession may be made to the UAE.”

| Prices |

|---|

|

Along the futures curve, the structure strengthened and timespreads moved deeper into backwardation. The three nearest timespreads for WTI hit $1 a barrel or more on Thursday, an indicator the market is increasingly worried about tightness, particularly at the key hub of Cushing, Oklahoma, where U.S. futures are priced. Brent’s September contract, meanwhile, was 93 cents a barrel more expensive than October, compared with 80 cents a week ago.

The UAE said it would only give its support to a deal if the baseline for its own cuts was raised considerably, delegates said, asking not to be identified because the talks were private. The nation’s reductions are measured from a starting point in 2018, which set its maximum capacity at 3.168 million barrels a day. But expansion projects have since raised that number to about 4 million barrels. Reflecting that new capacity in its baseline could allow it to pump hundreds of thousands of barrels a day of extra crude.

OPEC+ is likely to agree on Friday to restore more production, Neil Beveridge, a senior analyst at Sanford C Bernstein in Hong Kong, said in a Bloomberg TV interview. “We would expect a 400,000 barrels a day increase per month through the rest of this year just to keep the markets balanced,” he said. Brent is likely to exceed $80 a barrel soon, Beveridge said.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS