Saudi Arabia, OPEC’s top producer, has so far proceeded cautiously, with the persistence of Covid-19 and the potential restoration of Iranian supply clouding the market outlook. In a possible complication to talks on the Iranian nuclear deal, U.S. forces conducted air strikes Sunday against Iran-backed militias blamed for attacking American facilities in Iraq, the Defense Department said.

“Crude oil trades steady, with market participants expecting OPEC+ will keep supplies tight enough to support current levels,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S. “With virus uncertainties due to the highly contagious delta strain and questions about an Iran nuclear deal hanging over the market, the group may opt for caution,” hence current price strength.

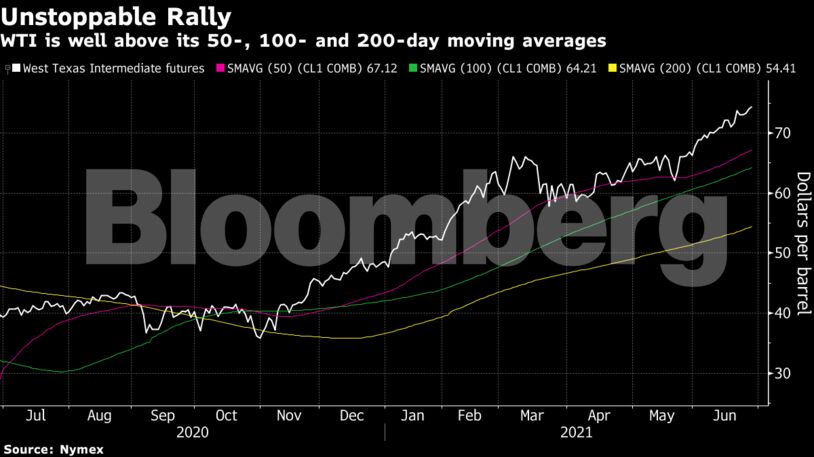

Oil has rallied this year as a rapid rebound from Covid-19 in major energy markets such as the U.S., Europe and China has led to increased mobility and greater consumption of transport fuels. The recovery has also drained bloated stockpiles, and the International Energy Agency has urged OPEC+ to return more supply to keep markets balanced.

| Prices |

|---|

|

The oil market’s structure continues to indicate tighter supply. Brent futures for August are 84 cents more expensive than those for September, a bullish structure known as backwardation.

All the while, the glut of crude stored at sea which built up during the pandemic continues to shrink. The stockpile fell 17% last week, according to Vortexa data, the lowest since early 2020.

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Canada’s Advantage as the World’s Demand for Plastic Continues to Grow