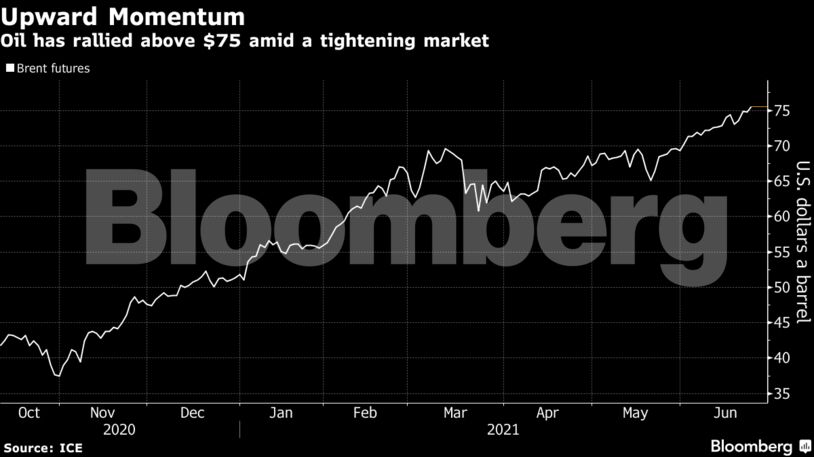

This latest sign of tightening comes as fuel demand bounces back from the pandemic and stalled nuclear talks defer the prospect of renewed Iranian supplies. The heads of Royal Dutch Shell Plc and TotalEnergies SE joined a chorus of industry figures warning that crude could return to $100 a barrel.

Key consumers including the U.S. and China have seen a strong rebound from Covid-19, boosting consumption and helping to drain bloated inventories built up during the pandemic. OPEC+ is scheduled to meet next week to discuss its production policy and some nations, most notably Russia, are considering backing an increase in output.

“Fundamental tailwinds are outnumbering the headwinds,” said Michael Tran, a strategist at RBC Capital Markets. From stalwart demand in emerging economies to “dramatically tightening” U.S. inventories, the market is the strongest it’s been since the middle of the last decade, he said.

| Prices |

|---|

|

Stockpiles at the key U.S. storage hub of Cushing also fell last week, but fuel inventories including gasoline rose, the API said. The Energy Information Administration is forecast to report on Wednesday that nationwide crude stockpiles slid by 3.5 million barrels, according to a Bloomberg survey.

The demand recovery in Asia, however, remains uneven. Improvements in nations such as India and Thailand are partially offset by deteriorations elsewhere. In Europe, air traffic is improving from the pandemic lows, but still remains far below 2019 levels, data from Eurocontrol show.

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS