Insurance companies Axa, Zurich and Swiss Re continue to invest in, insure countries that lack Canada’s freedoms

Download the PDF here

Download the charts here

Executive Summary

Insurance companies Axa, Swiss Re, and Zurich versus Canadian oil and gas

Property and casualty (P&C) insurance allows oil and gas companies to protect themselves against such events as damage to property, accidents and other incurred liabilities.

According to HTF Market Intelligence, the size of the oil and gas property and casualty (P&C) insurance premiums market was about $17.3 billion in 2018. Market size for P&C insurance ranged from North America (43 per cent of the total), Europe (25 per cent of the total), Asia and Pacific (20 per cent of the total) and Middle East and Africa (7 per cent of the total). (HTF Market Intelligence, 2020).

Some of the world’s largest insurance companies are coming under increasing pressure from environmental groups to stop providing insurance coverage and to stop investing in oil sands projects in Canada (New York Times, 2020).

Over the past two years, Axa, Swiss Re¹ and Zurich Insurance Group, specifically, have announced they will restrict or entirely stop providing P&C insurance coverage to Canadian oil sands projects. They have also pledged to reduce or eliminate their investments in the oil and gas sector. Investments include corporate bonds, corporate securities, equities mortgage, loans and real estate, among others. While these companies have apparently bowed to pressure from some anti-oil and gas activists to curtail their investments in Canadian oil and gas, they continue to invest in other countries, including those considered “Not Free.” This report profiles the investments and insurance coverage of these three insurers in Not Free countries², where civil and other rights, labour standards and environmental are often far below those of Free countries.

1. Swiss Reinsurance Company Ltd, commonly known as Swiss Re. 2. The term “Not Free” is from the Washington DC-based think tank, Freedom House, which has measured and ranked countries and territories by their degree of freedom since 1973. Their broad rankings are: Free, Partly Free, and Not Free. For more, see Freedom House (2020).

A worldwide look: $317 billion insured in “Not Free” countries (all three insurers)

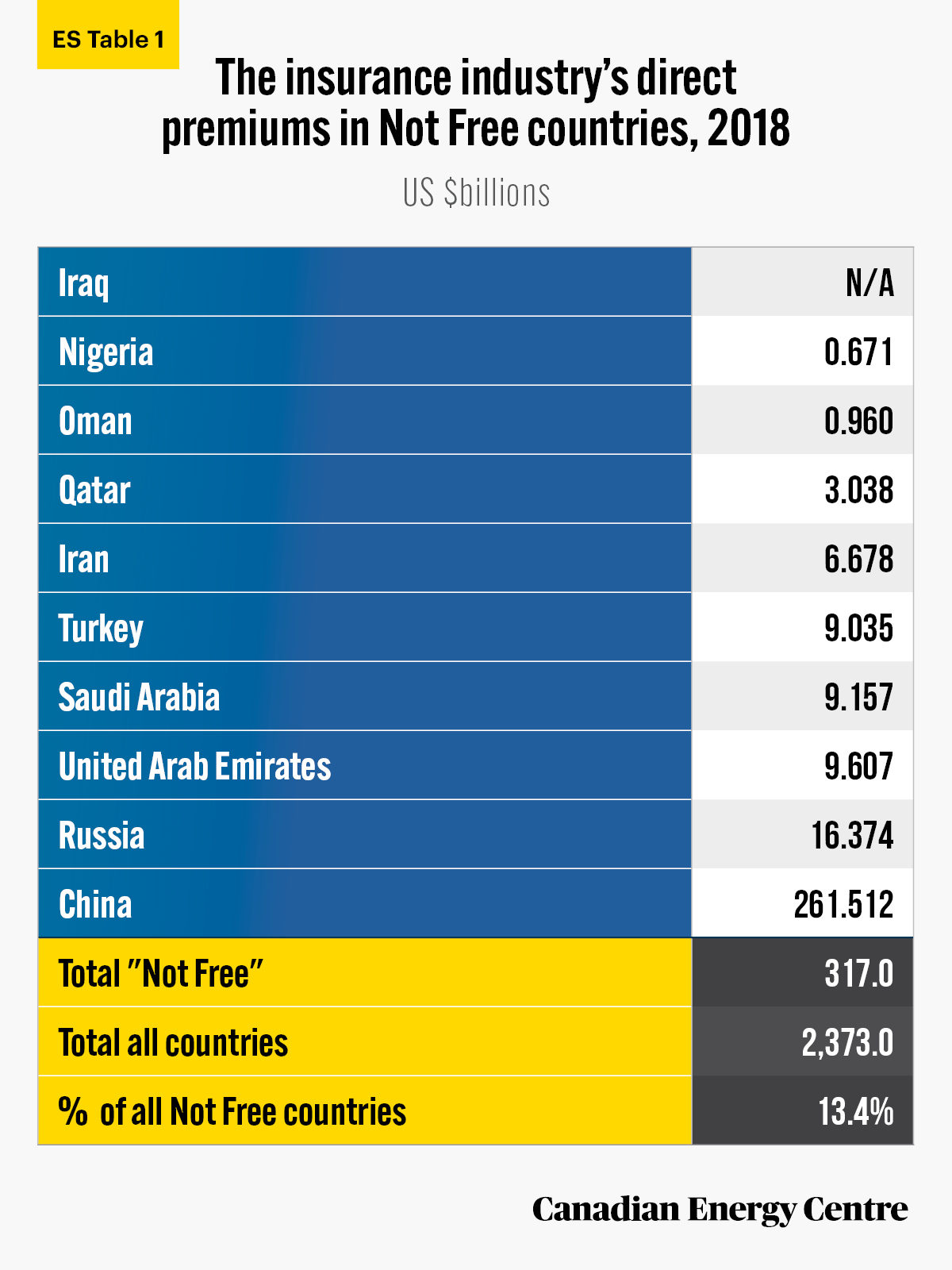

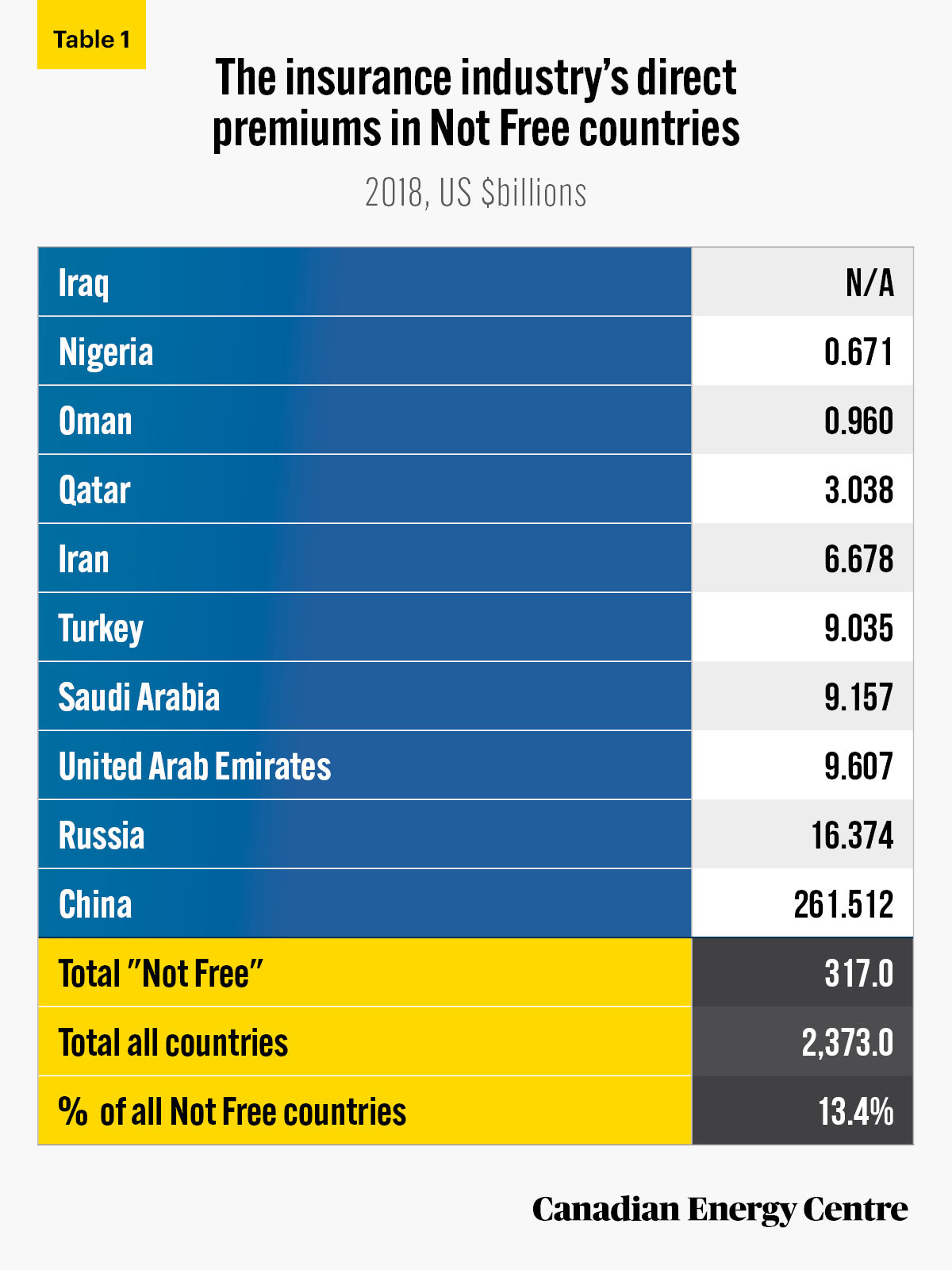

According to the Insurance Information Institute, among “Not Free” countries examined in this report, non-life written direct premiums in 2018 totalled about $317 billion, or 13.3 per cent of total worldwide non-life premiums. (Non-life insurance includes property and casualty (P&C) insurance coverage for both individuals and businesses.) When a nonlife P&C insurance company issues a contract to provide insurance against loss, the revenues or premiums expected to be received over the life of the contract are called non-life written direct premiums. This ranged from a high of $261 billion in China to a low of $671 million in Nigeria (Insurance Information Institute, 2020).

Source: Insurance Information Institute, 2020 Insurance Fact Book.

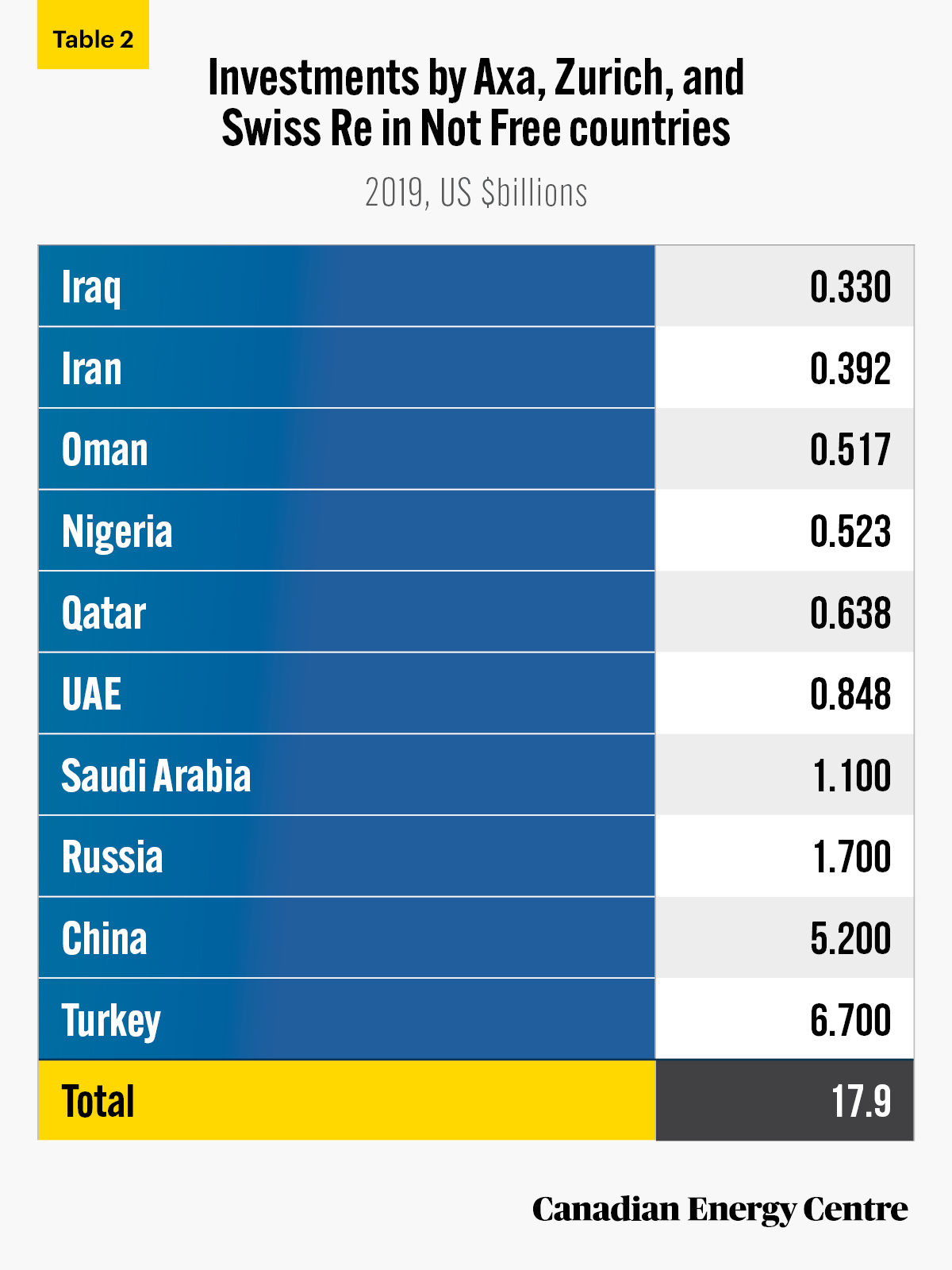

Investments in “Not Free” countries by Axa, Zurich, and Swiss Re

Despite announcing a pull-back in their investments and property and casualty (P&C) coverage of oil sands projects in Canada, the insurance companies Axa, Zurich, and Swiss Re continue to invest in and provide P&C insurance coverage in

“Not Free” countries of Saudi Arabia, Russia, China, the United Arab Emirates, Turkey, Nigeria, Iran, Iraq, Qatar and Oman in 2019.

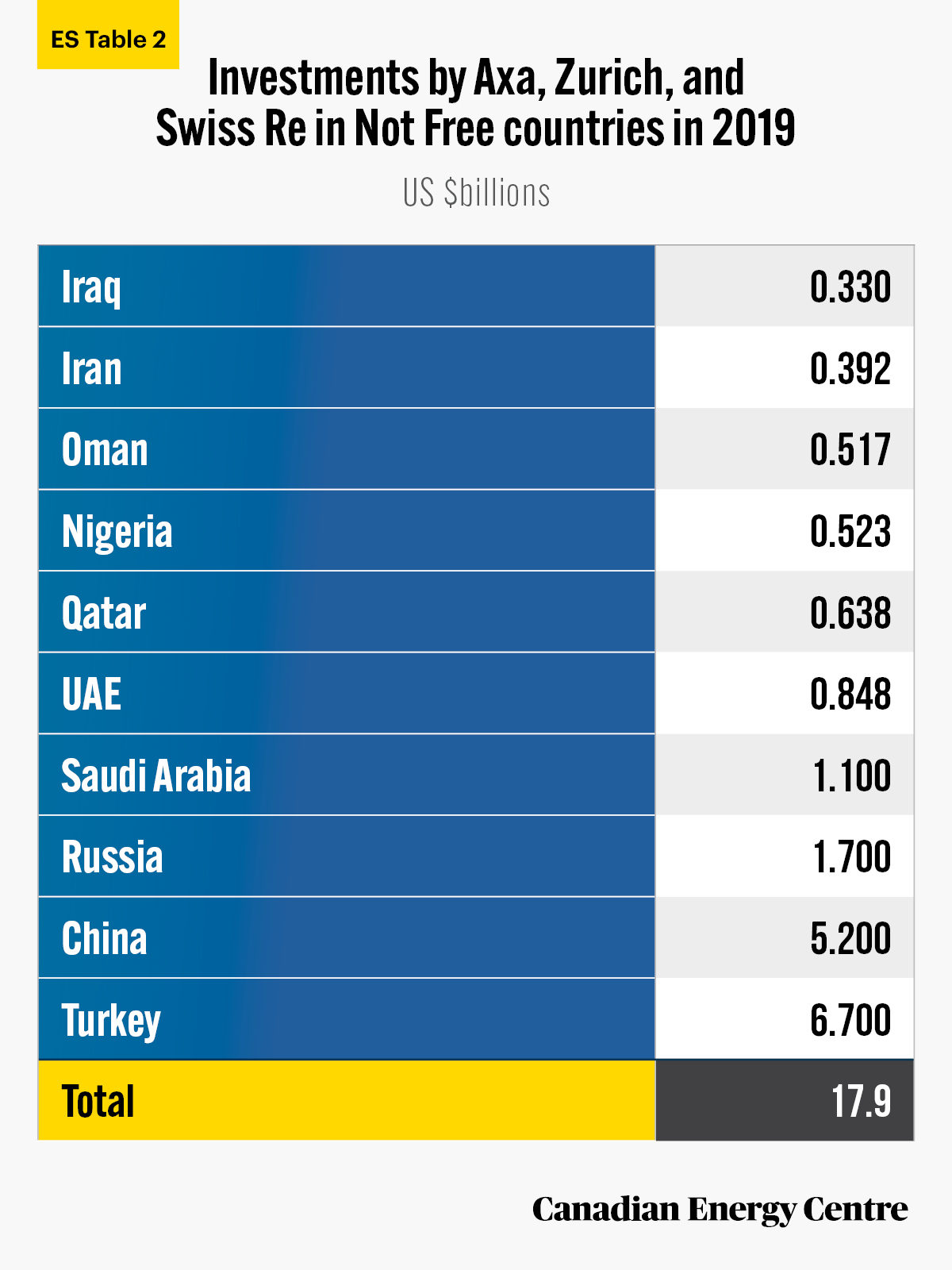

Of the $1 trillion in investments that Axa, Zurich and Swiss Re made worldwide in 2019, $17.9 billion or 1.8 per cent were in “Not Free” countries examined in this report. Those investments ranged from $330 million in Iraq to $6.7 billion in Turkey (see ES Table 2).

Sources: HTF Market Intelligence, Property & Casualty Comprehensive Study 2020. Custom research for the Canadian Energy Centre.

Insurance premiums written in “Not Free” countries (by nation)

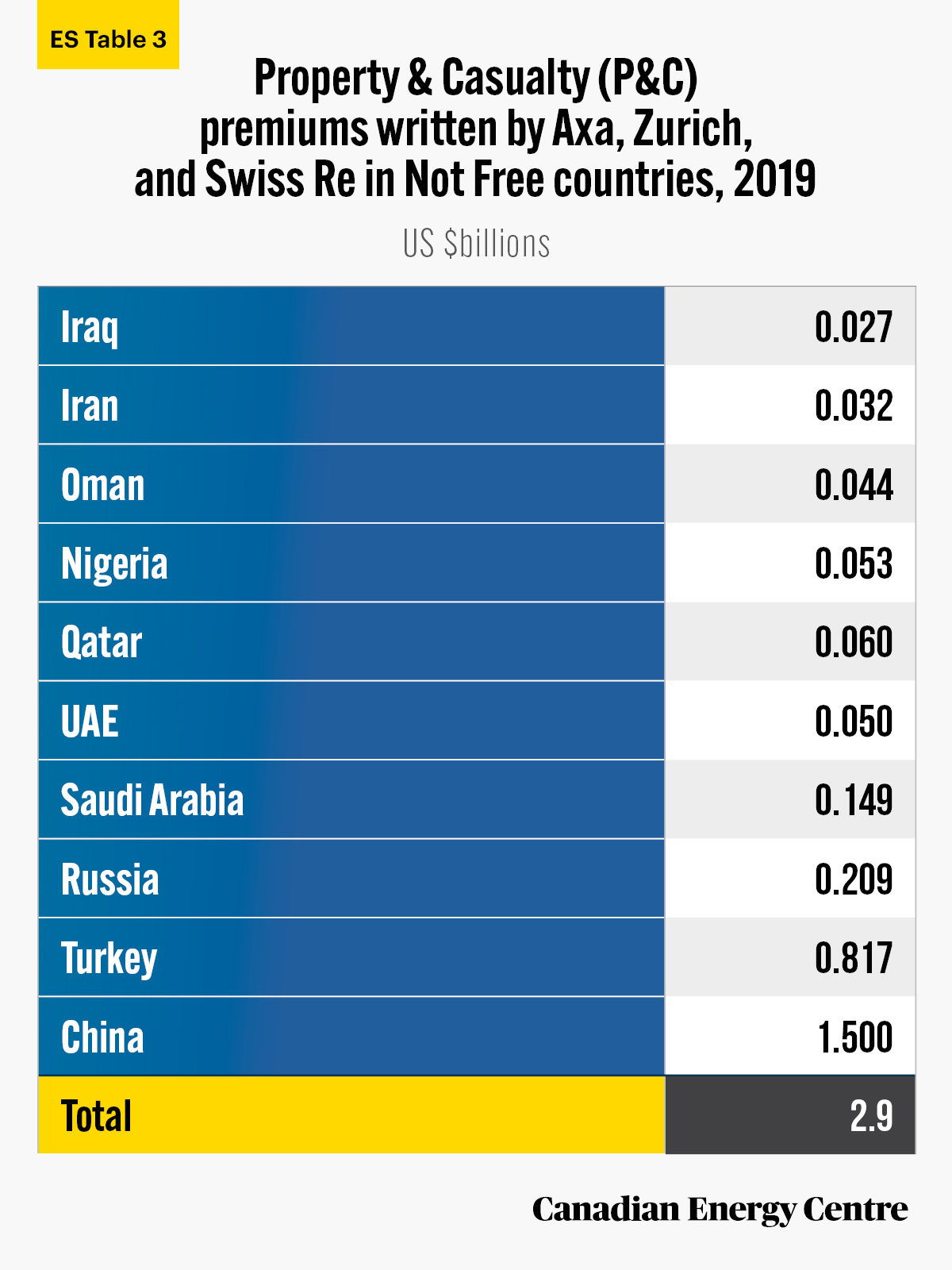

Of the $110.4 billion in P&C insurance premiums written worldwide by Axa, Zurich, and Swiss Re in 2019, $2.9 billion or 2.6 per cent was written in “Not Free” countries examined in this report. The amounts ranged from $27 million in Iraq to $1.5 billion in China (see ES Table 3).³

3. There may be some slight variations in the values of total worldwide investments and P&C insurance premiums written by Axa, Zurich and Swiss Re between HTF Intelligence and company annual reports due to differences in methodologies used to determine investments by class and P&C insurance premiums written.

Source: HTF Market Intelligence, Property & Casualty Comprehensive Study 2020. Custom research for the Canadian Energy Centre.

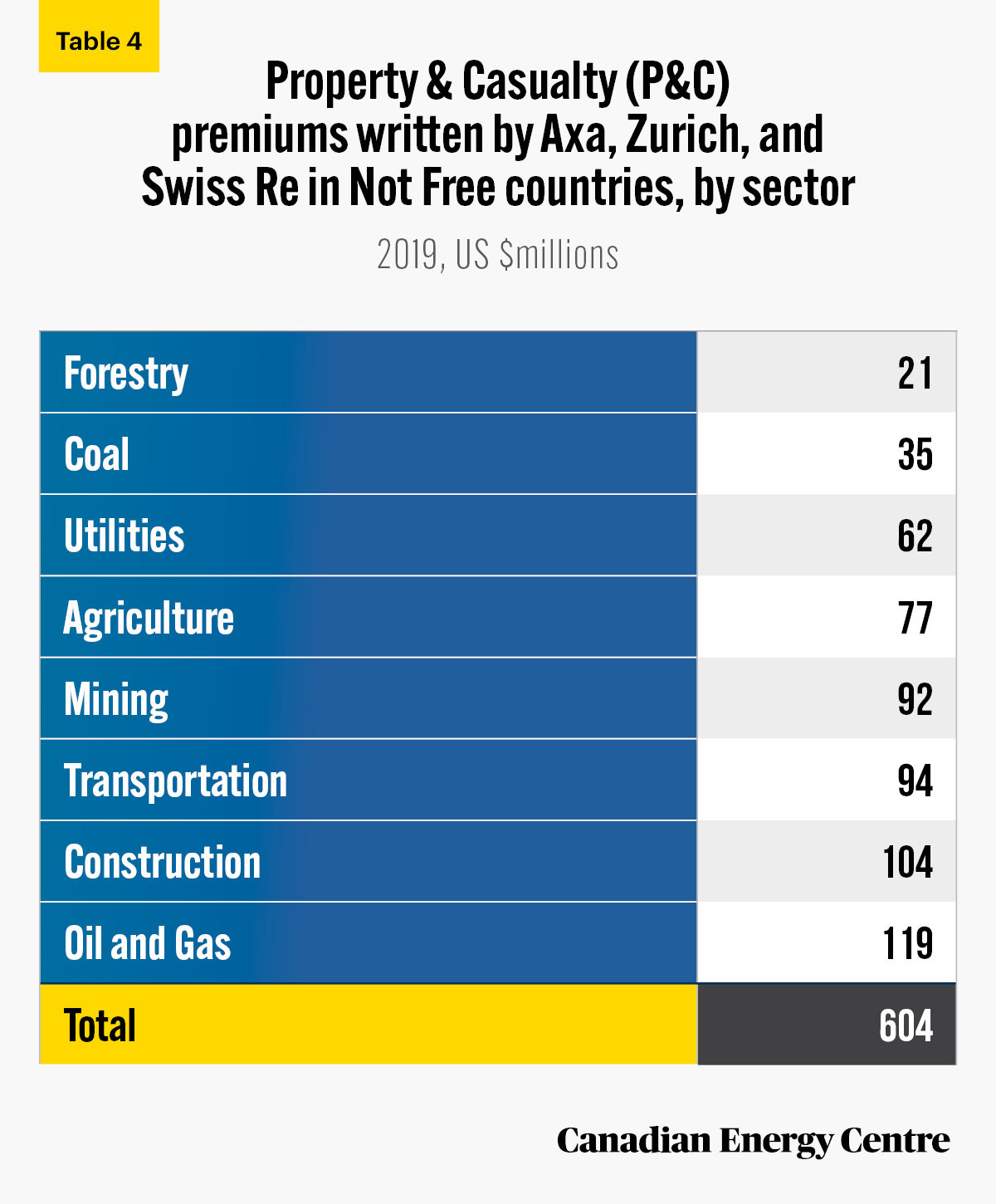

Insurance premiums written in Not Free countries (by industry)

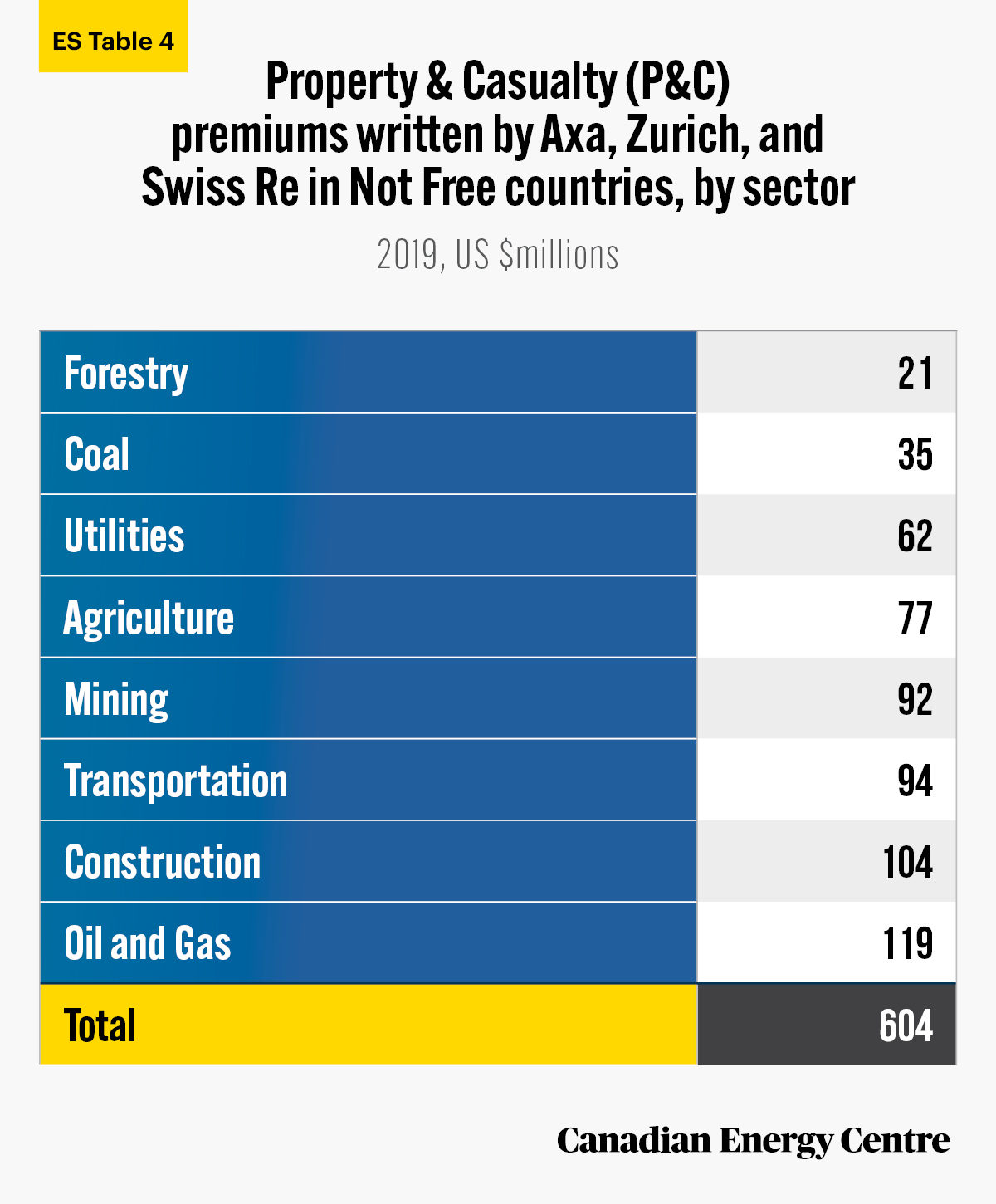

Axa, Zurich, and Swiss Re also continued to provide P&C insurance coverage in various industry sectors in “Not Free” countries in 2019. The $2.9 billion in P&C insurance premiums that Axa, Zurich, and Swiss Re wrote in 2019 in the “Not Free” countries examined in this report ranged from $21 million in forestry to $119 million in the oil and gas sector (see ES Table 4).

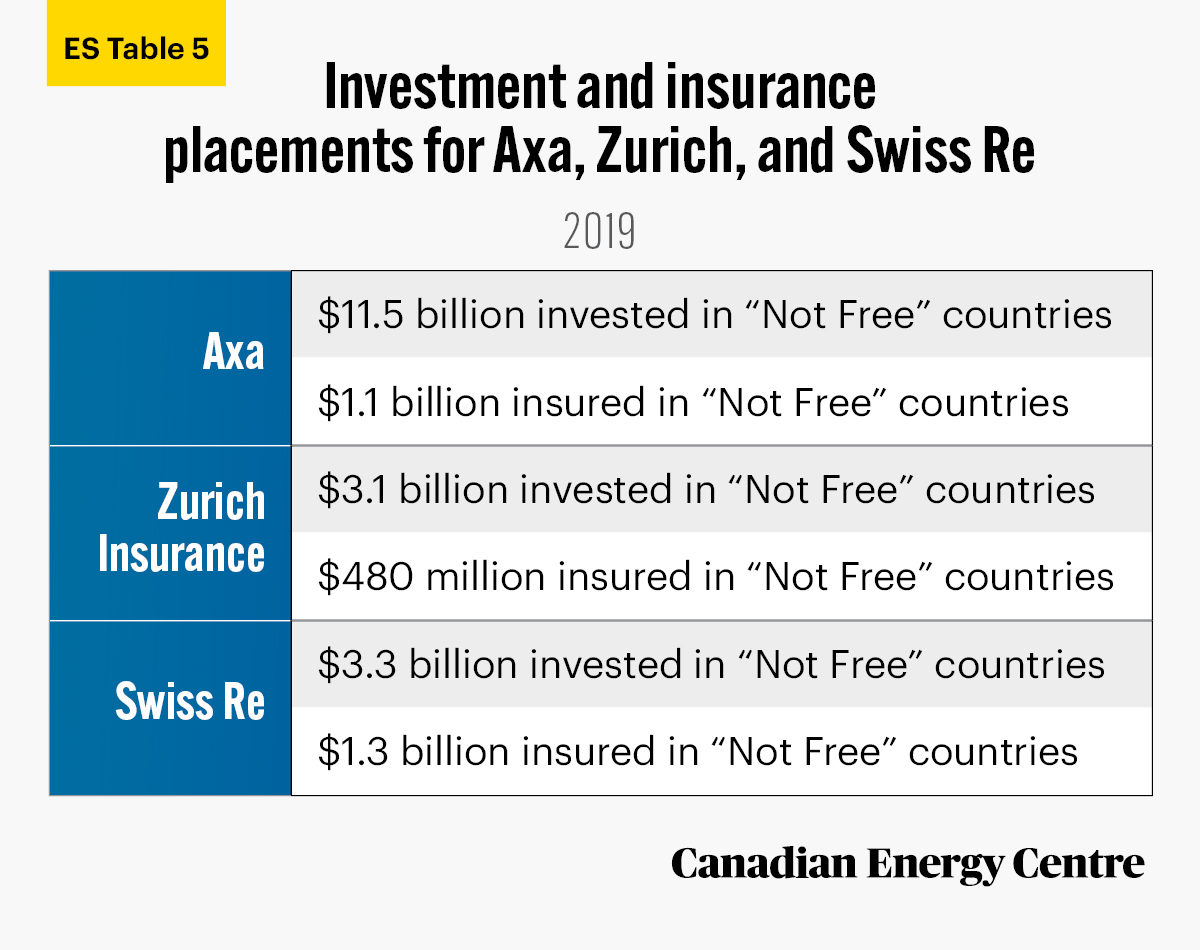

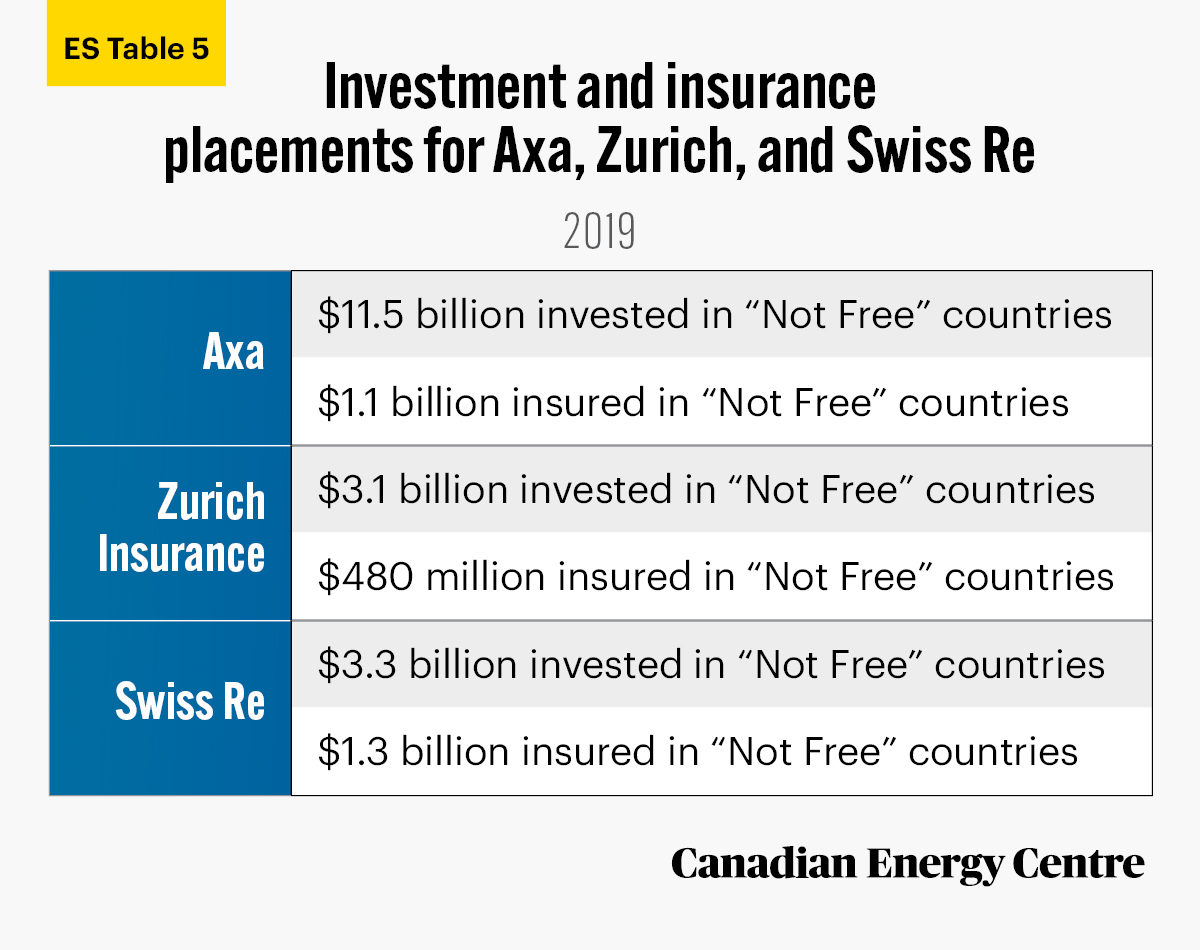

A summary view

- In summary, Axa, Zurich, and Swiss Re hold investments worth $17.9 billion in “Not Free” countries

- They also wrote $2.9 billion in Property and Casualty (P&C) insurance premiums in “Not Free countries

Here are the values of the investments and insurance policies held by company in “Not free” countries.

Source: HTF Market Intelligence, Property & Casualty Comprehensive Study 2020. Custom research for the Canadian Energy Centre.

Source: Derived from HTF Market Intelligence, Property and Casualty Comprehensive Study 2020, Custom research for the Canadian Energy Centre.

Introduction

Property and casualty (P&C) insurance allows oil and gas companies to protect themselves against such events as damage to property, accidents and other incurred liabilities.

According to HTF Market Intelligence, the size of the oil and gas property and casualty (P&C) insurance premiums market was about $17.3 billion in 2018. Market size for P&C insurance ranged from North America (43 per cent of the total), Europe (25 per cent of the total), Asia and Pacific (20 per cent of the total) and Middle East and Africa (7 per cent of the total). (HTF Market Intelligence, 2020)

Some of the world’s largest insurance companies are coming under increasing pressure from some anti-oil and natural gas activists to stop providing insurance coverage and to stop investing in oil sands projects in Canada.

At least three of the world’s largest insurance companies (Axa, Zurich Insurance Group, and Swiss Reinsurance Company Ltd (known colloquially as Swiss Re) have announced they will restrict or entirely stop providing P&C insurance coverage to Canadian oil sands projects (New York Times, 2020). They have also pledged to reduce or eliminate their investments in the oil and gas sector. Investments include corporate bonds, corporate securities, equities mortgage, loans and real estate, among others.

While Axa, Swiss Re, and Zurich Insurance have indicated they intend to pull back on oil sands projects in Canada, they continue to provide insurance coverage and investments in major commercial and retail projects in countries designated as “Not Free” by Freedom House, a Washington D.C.-based think tank.

(Freedom House categorizes nations and territories by their degree of freedom with three possible overall rankings: Free, Partly Free, and Not Free, and has done so since 1973 (Freedom House, 2020).)

In this Research Brief, CEC uses premium data obtained from HTF Market Intelligence to examine investments and P&C premiums in 2019 for Axa, Zurich and Swiss Re in the “Not Free” countries of Saudi Arabia, Russia, China, the United Arab Emirates, Turkey, Nigeria, Iran, Iraq, Qatar, and Oman. All dollar totals expressed in this report are in US dollars.

HTF Market Intelligence is a company that focuses on market intelligence and data analytics. It has acquired data on the worldwide insurance sector by conducting primary interviews and using data from secondary online portals like Bloomberg, Factiva, Manta, and data.com.

Overview of the worldwide insurance industry

All three insurers have $317 billion insured in “Not Free” countries

According to the Insurance Information Institute, non-life written direct premiums by all insurers in 2018 totalled about $317 billion spread among the “Not Free” countries examined in this report, or 13.3 per cent of total worldwide non-life premiums. The premium coverage ranged from a high of $261 billion in China to a low of $671 million in Nigeria (Insurance Information Institute, 2020) (see Table 1).

Source: Insurance Information Institute, 2020 Insurance Fact Book.

Key findings

Axa, Zurich, and Swiss Re held investments in “Not Free” countries worth $17.9 billion

Of the over $1 trillion in investments worldwide by Axa, Zurich, and Swiss Re in 2019, $17.9 billion or 1.8 per cent were in “Not Free” countries examined in this report. Those investments ranged in value from $330 million in Iraq to $6.7 billion in Turkey (see Table 2).

Sources: HTF Market Intelligence, Property & Casualty Comprehensive Study 2020. Custom research for the Canadian Energy Centre.

$2.9 billion in P&C Insurance Premiums Written

Of the $110.4 billion in P&C insurance premiums written worldwide by Axa, Zurich, and Swiss Re in 2019, $2.9 billion or 2.6 per cent was written in “Not Free” countries examined in this report. They ranged from just under $27 million in Iraq to $1.5 billion in China (see Table 3).

Source: HTF Market Intelligence, Property & Casualty Comprehensive Study 2020. Custom research for the Canadian Energy Centre.

Axa, Zurich, and Swiss Re wrote premiums for coal, oil and gas, and other resource sectors in “Not Free” countries

The $2.9 billion in P&C insurance premiums that Axa, Zurich, and Swiss Re wrote in 2019 in the “Not Free” countries examined in this report included $35 million for the coal sector and $119 million for the oil and gas sector, among others (see Table 4).

Source: HTF Market Intelligence, Property & Casualty Comprehensive Study 2020. Custom research for the Canadian Energy Centre.

Breakdowns by company

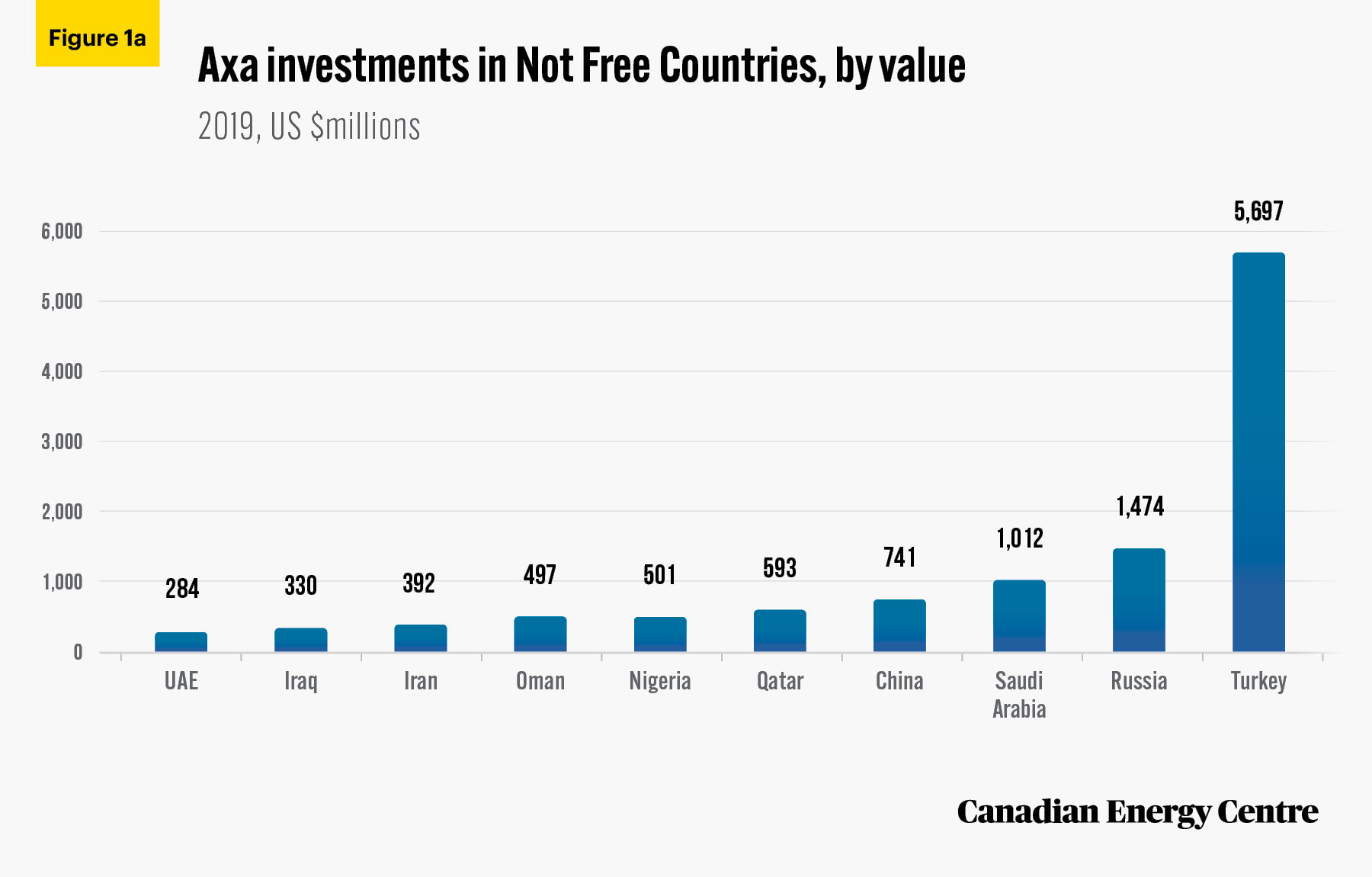

Axa: $11.5 billion invested in “Not Free” countries

Of the $674 billion in worldwide investments that Axa made in 2019, $11.5 billion or 1.7 per cent was in “Not Free” countries examined in this report, ranging from $284 million in the United Arab Emirates to $741 million in China, over $1 billion in Saudi Arabia, almost $1.5 billion in Russia, and $5.7 billion in Turkey (see Figure 1a).

Source: HTF Market Intelligence, Property & Casualty Comprehensive Study 2020. Custom research for the Canadian Energy Centre.

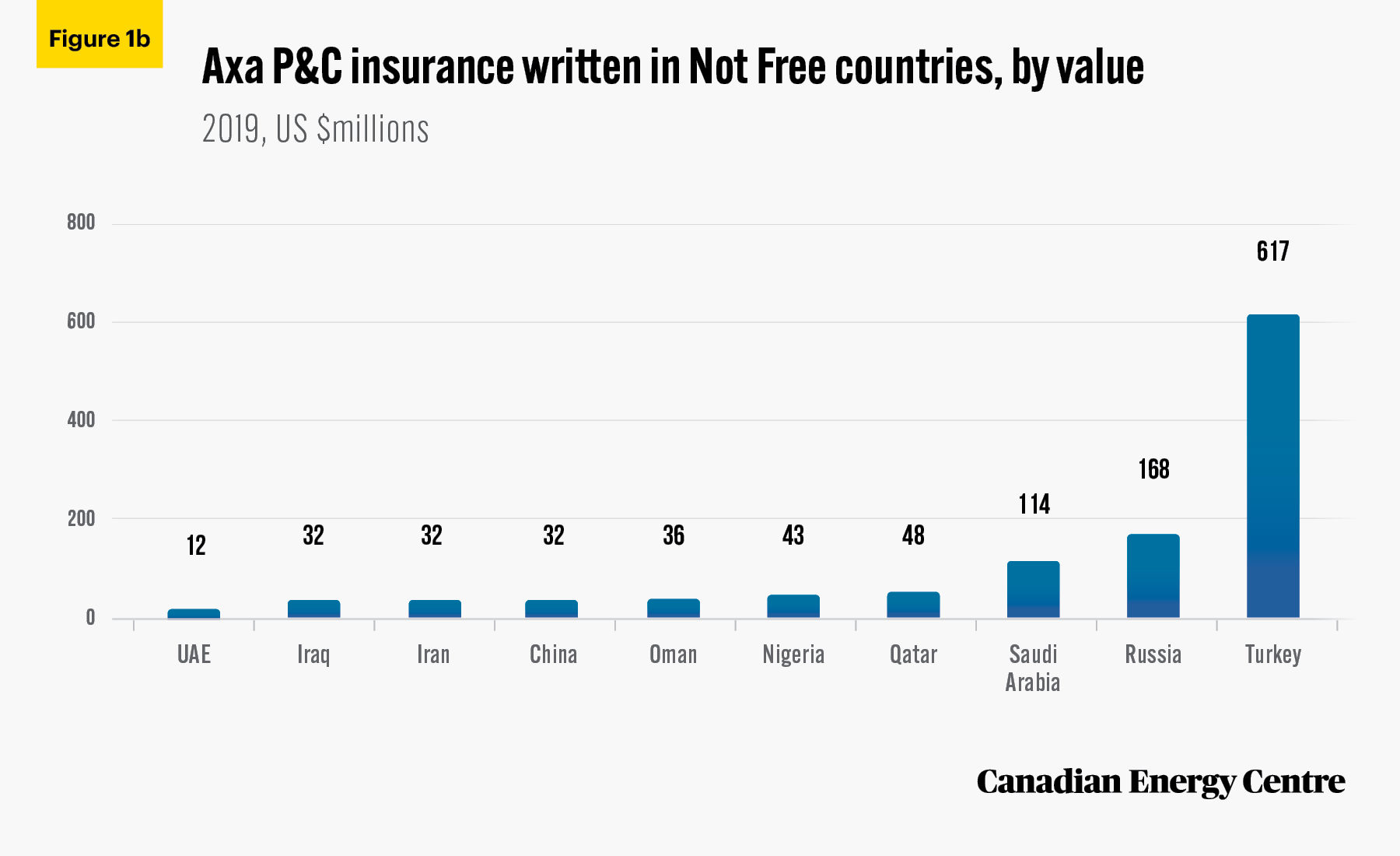

Axa: $1.1 billion insured in “Not Free” countries

Of the $54.7 billion in P&C insurance premiums that Axa wrote worldwide in 2019, $1.1 billion or 2 per cent was in “Not Free” countries examined in this report, ranging from $12 million in the United Arab Emirates to as much as $617 million in Turkey (see Figure 1b).

Source: HTF Market Intelligence, Property & Casualty Comprehensive Study 2020. Custom research for the Canadian Energy Centre.

Axa: What’s insured in “Not Free” countries, by sector

Of the $1.1 billion in P&C insurance premiums written by Axa in “Not Free” countries examined in this report, some of the written premiums as of 2019, by sector, include:

- $6.0 million in forestry;

- $7.4 million in coal;

- $23.5 million in utilities

- $26.1 million in agriculture;

- $33.3 million in mining;

- $37.4 million in transportation

- $37.9 million in construction;

- $42.3 million in oil and gas; and

- $920 million in others.

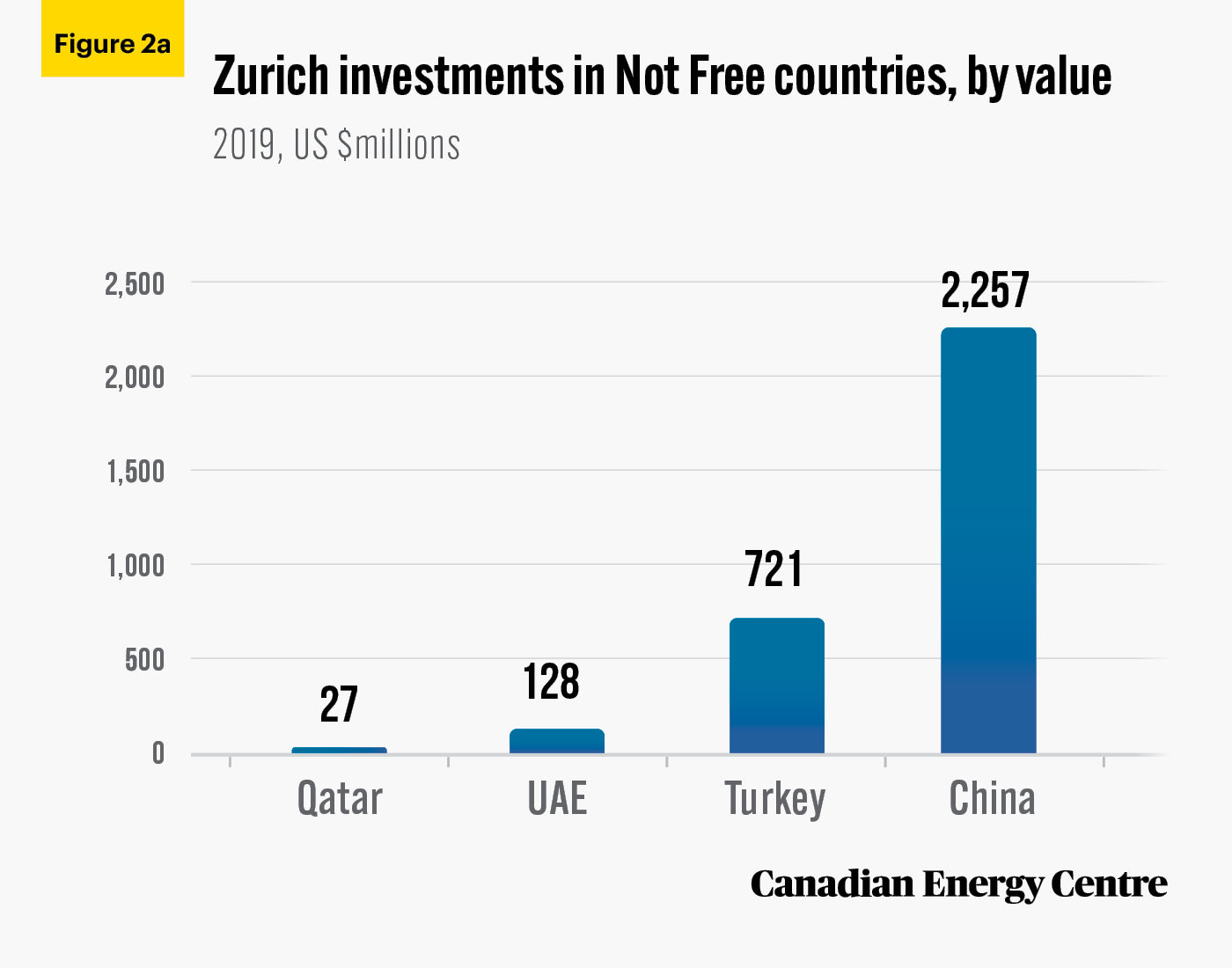

Zurich: $3.1 billion invested in “Not Free” countries

Of the $204.8 billion in investments Zurich Insurance Group made worldwide in 2019, $3.1 billion or 1.5 per cent was in investments in “Not Free” countries examined in this report, ranging from $27 million in Qatar to almost $2.3 billion in China (see Figure 2a).

Source: HTF Market Intelligence, Property & Casualty Comprehensive Study 2020. Custom research for the Canadian Energy Centre.

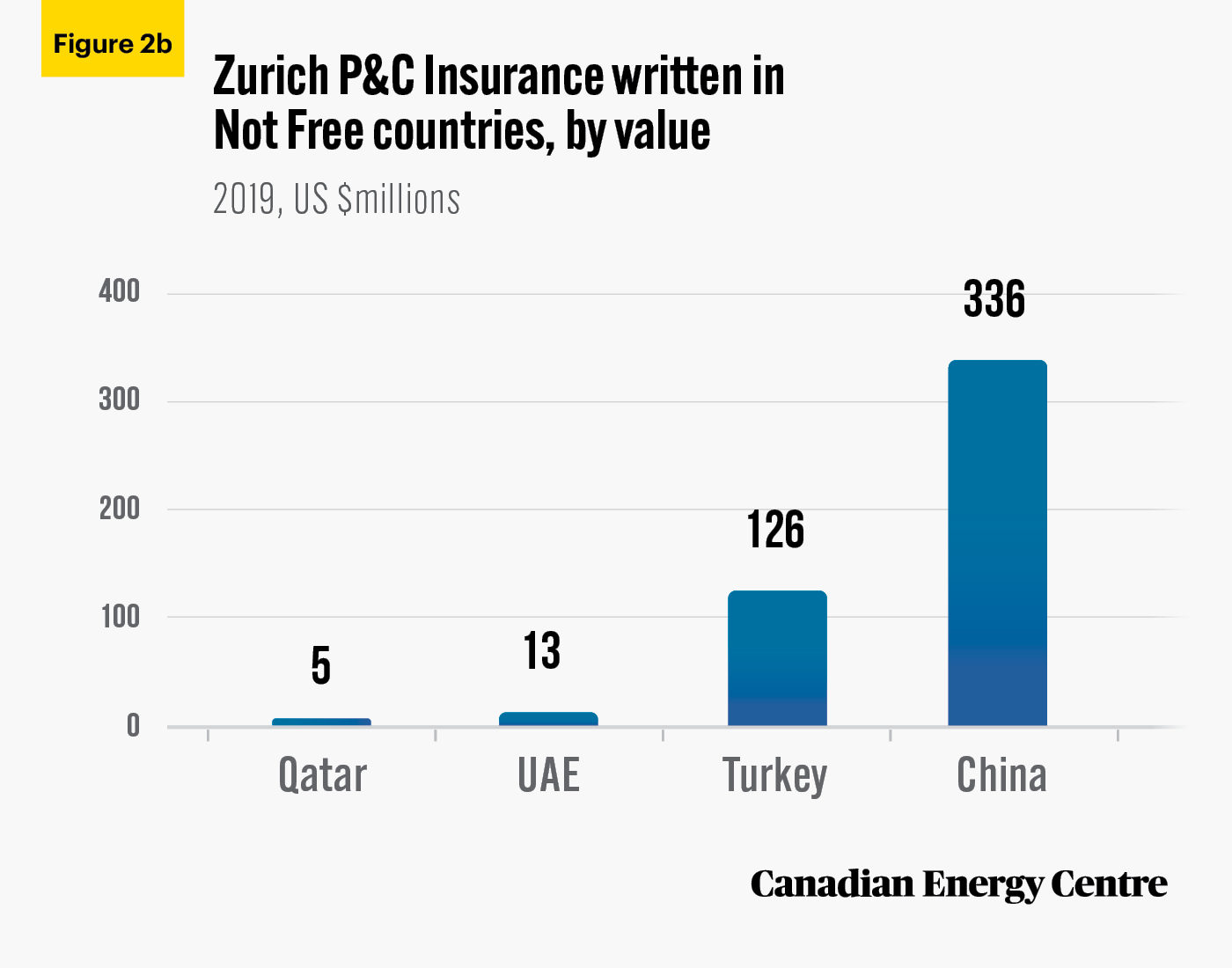

Zurich: $480 million insured in “Not Free” countries

Of the $34.2 billion in P&C insurance premiums that Zurich wrote worldwide in 2019, $480 million or 1.4 per cent was written in “Not Free” countries examined in this report, ranging from $5.0 million in Qatar to over $336 million in China (see Figure 2b).

Source: HTF Market Intelligence, Property & Casualty Comprehensive Study 2020. Custom research for the Canadian Energy Centre.

Zurich: What’s insured in “Not Free” countries, by sector

Of the nearly $474 million in P&C insurance premiums written by Zurich in “Not Free” countries examined in this report, some of the written premiums as of 2019, by sector, include

- $2.8 million in forestry;

- $3.3 million in coal;

- $7.6 million in agriculture;

- $9.9 million in utilities;

- $10.7 million in mining;

- $14.8 million in transportation;

- $19.1 million in oil and gas;

- $22.2 million in construction; and

- $383.3 million in others.

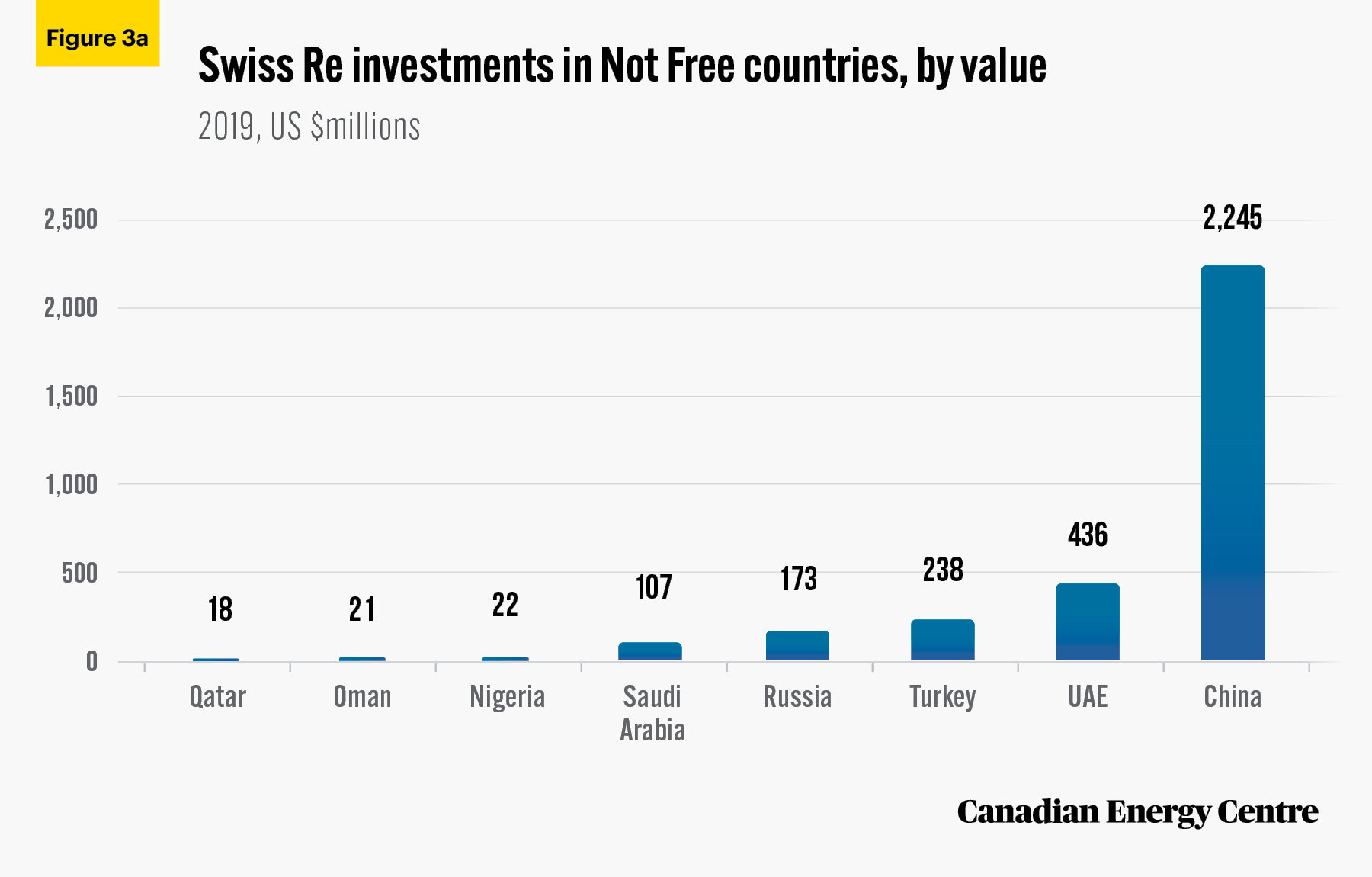

Swiss Re: $3.3 billion invested in “Not Free” countries

Of the over $135.2 billion in investments that Swiss Re made worldwide in 2019, nearly $3.3 billion or 2.4 per cent were in “Not Free” countries examined in this report. The value of those investments ranged from just under $18 million in Qatar to over $2.2 billion in China (see Figure 3a).

Source: HTF Market Intelligence, Property & Casualty Comprehensive Study 2020. Custom research for the Canadian Energy Centre.

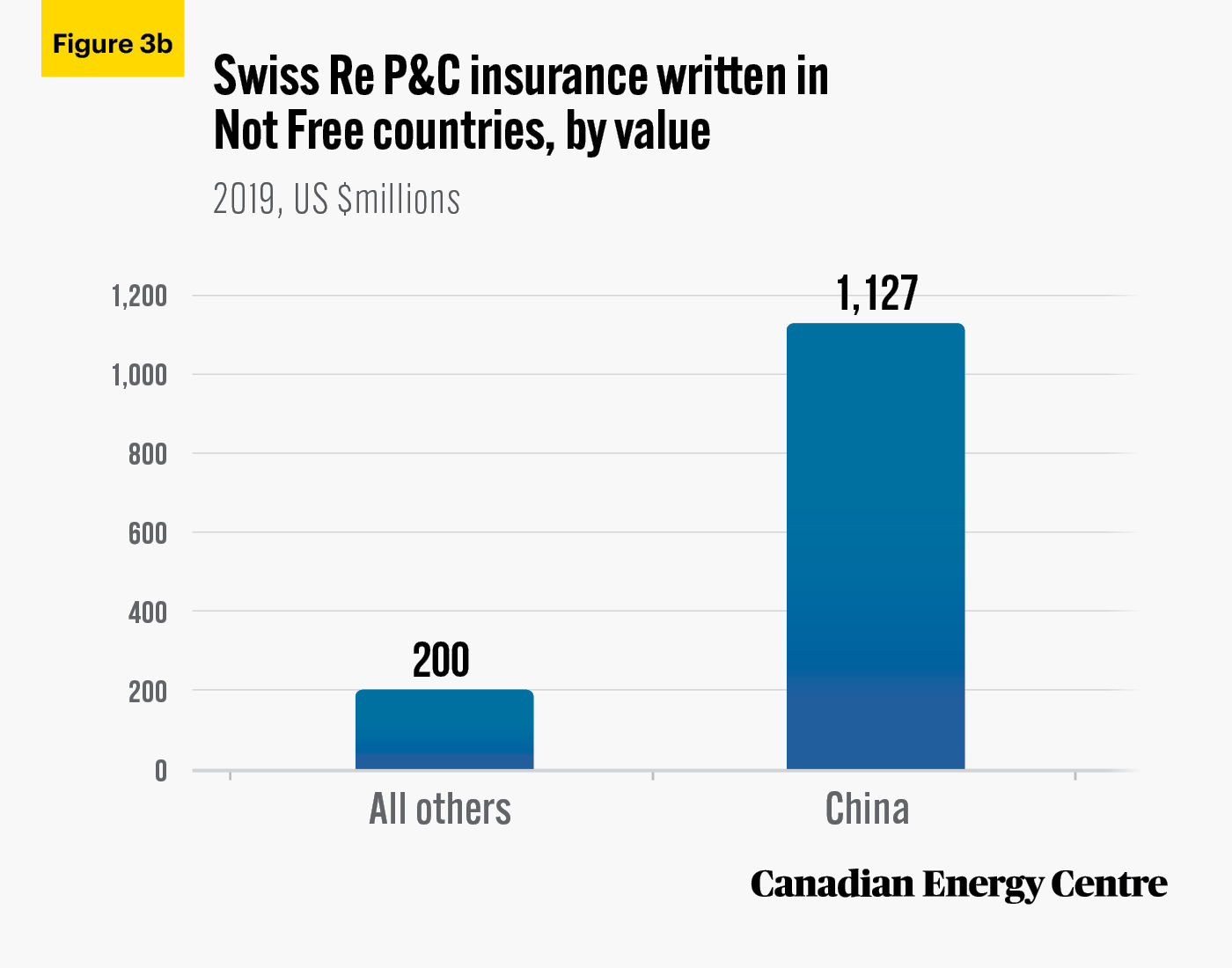

Swiss Re: $1.3 billion insured in “Not Free” countries

Of the $21.6 billion in the P&C insurance premiums written worldwide by Swiss Re in 2019, $1.3 billion or 6.1 per cent was written in “Not Free” countries examined in this report. The vast majority of the P&C insurance premiums—85 per cent—were written in China and worth just over $1.1 billion. The remaining $200 million in written premiums were spread among Saudi Arabia, Russia, the United Arab Emirates, Turkey, Nigeria, Qatar, and Oman (see Figure 3b).

Source: HTF Market Intelligence, Property & Casualty Comprehensive Study 2020. Custom research for the Canadian Energy Centre.

Swiss Re: What’s insured in “Not Free” countries, by sector

Of the $1.3 billion in P&C insurance premiums that Swiss Re wrote in “Not Free” countries examined in this report, some of the written premiums in 2019, by sector, include

- $11.7 million in forestry;

- $24.1 million in coal;

- $28.3 million in utilities;

- $41.7 million in transportation;

- $43.3 million in agriculture;

- $43.6 million in construction;

- $49.3 million in mining;

- $57.6 million in oil and gas; and

- $1.0 billion in others.

Summary for all three companies

The breakdown by company is in Table 5.

Source: Derived from HTF Market Intelligence, Property and Casualty Comprehensive Study 2020, Custom research for the Canadian Energy Centre.

Summary

Although they announced that they were pulling back from investing and insuring oil sands projects in Canada, the insurance companies Axa, Zurich, and Swiss Re continue to invest in and provide P&C insurance coverage in the “Not Free” countries of Saudi Arabia, Russia, China, the United Arab Emirates, Turkey, Nigeria, Iran, Iraq, Qatar, and Oman, as of 2019.

• At the end of 2019, investments by Axa, Zurich, and Swiss Re in “Not Free” countries totaled $17.9 billion.

• In 2019, P&C insurance premiums written by Axa, Zurich, and Swiss Re in “Not Free” countries totaled $2.9 billion.

• In that same year, Axa, Zurich, and Swiss Re provided $2.9 billion in P&C insurance coverage to various industry sectors in several “Not Free” countries examined in this report, including $119 million in oil and gas, $104 million in construction, $94 million in transportation, and $92 million in mining.

References

Freedom House (2020). Countries and Territories: Global Freedom Scores. <https://bit.ly/2yS1IPf>.

HTF Market Intelligence (2020). Global Property Insurance in the Oil and Gas Sector, Market Size, Status and Forecast 2020-2025. <https://bit.ly/3lFDhbm>.

HTF Market Intelligence, Property & Casualty Comprehensive Study 2020. Custom Research for the Canadian Energy Centre.

Insurance Information Institute. (2020). Insurance Fact Book. <https://bit.ly/3feawQF>.

New York Times. (2020). Global Financial Giants Swear Off Funding an Especially Dirty Fuel. <https://nyti.ms/35ydGLG>.

Swiss Re (2020). World Insurance: Riding Out the 2020 Pandemic Storm. Sigma, number 4. <https://bit.ly/3nw7Pwn>.

CEC Research Briefs

Canadian Energy Centre (CEC) Research Briefs are contextual explanations of data as they relate to Canadian energy. They are statistical analyses released periodically to provide context on energy issues for investors, policymakers and the public. The source of profiled data depends on the specific issue.

About the authors

This CEC Research Brief was compiled by Lennie Kaplan, M.A., Chief Research Analyst, and Mark Milke, Ph.D., Executive Director of Research for the Canadian Energy Centre.

Acknowledgments

The authors and the Canadian Energy Centre would like to thank and acknowledge the assistance of an anonymous reviewer of this paper.

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) is available for public usage under creative commons copyright terms with attribution to the Canadian Energy Centre. Attribution and specific restrictions on usage including non commercial use only and no changes to material should follow guidelines enunciated by Creative Commons here: Attribution NonCommercial-NoDerivs CCBY-NC-ND.

Photo Credits

Skyscrapers by Burst on Pexels.com, Oil Refinery by John R. Perry from Pixabay.com, Fire Fighter by Tim Eiden from Pexels.com, Shanghai, China by Ayala from Pexels.com, Pumpjack by Zbynek Burival on Unsplash.com, Office desk by Scott Graham on Unsplash.com, Glass building by Hector J. Rivas on Unsplash.com

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Canadians Should Decide What to do With Their Money – Not Politicians and Bureaucrats