By Sharon Cho and Alex Longley

Oil-market sentiment had improved this week amid some positive signals on consumption from Asia. But the likelihood of drastic curbs on movement being reintroduced in some of Europe’s largest cities has fueled demand fears. London is set to face harsher measures from Friday night.

“Renewed concerns of new restrictions across Europe are weighing on sentiment and oil prices,” said Giovanni Staunovo, a commodity analyst at UBS Group AG. A stronger dollar is also weighing on prices, he said.

| Prices |

|---|

|

U.S. inventory data due later Thursday could be a bright spot, with the American Petroleum Institute reporting a 5.42 million-barrel weekly decline in crude stockpiles, according to people familiar with the figures. That would be the biggest weekly drop since August if confirmed by the government’s numbers. The API report also showed lower gasoline and distillate stockpiles.

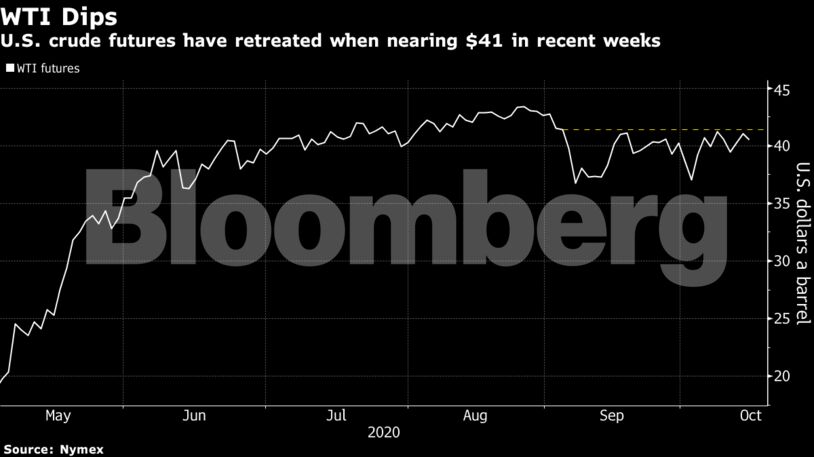

With the imposition of more measures to combat a resurgent virus in Europe and a renewed increase in U.S. infections, the market remains wary of plans by OPEC+ to raise oil supply in 2021 in line with its agreement earlier this year.

See also: OPEC+ Sees Cuts Compliance at 102% in Sept.: Delegates

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Canadians Should Decide What to do With Their Money – Not Politicians and Bureaucrats