By Low De Wei and Alex Longley

Investors are waiting for the conclusion of a Federal Reserve policy meeting on Wednesday, with the U.S. central bank expected to signal it will keep interest rates near zero for longer as the coronavirus continues to surge. Florida reported a record death toll, while a resurgence of cases across the Asia-Pacific is being viewed as an early warning sign for the rest of the world.

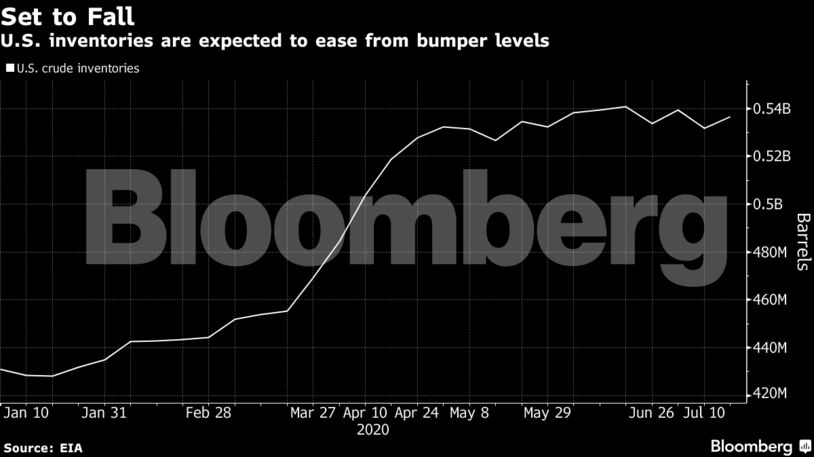

After rebounding swiftly from April lows, crude prices have struggled to find direction in recent weeks as the resurgent pandemic threatens the global energy demand recovery. Consultant Rystad Energy AS said it expects a second virus wave and additional barrels from the OPEC+ alliance to result in a global supply glut for the next four months.

“The upshot is that the specter of renewed containment measures looms large” over the market, said PVM Oil Associates analyst Stephen Brennock. “All the while, market players await further U.S. stimulus.”

| Prices |

|---|

|

The U.S. crude benchmark’s three-month timespread was 70 cents a barrel in contango — where near-dated contracts are cheaper than later-dated ones — compared with 31 cents in contango at the end of June. The change in the market structure indicates concerns about oversupply have risen this month.

As the market recovery teeters, the world’s largest independent oil storage company, Royal Vopak NV, said that its tanks are filling and almost all space remains booked up. While not necessarily an echo of the scramble for storage that pushed prices below zero earlier in the year, it’s a reminder of the level of uncertainty that exists in the oil market.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Canada’s Advantage as the World’s Demand for Plastic Continues to Grow