By Elizabeth Low and Alex Longley

Up to this point, the production curbs have been effective. Crude rallied almost 90% last month, a record gain, as reduced supply helped to offset the demand losses from the coronavirus outbreak. A key oil spread that helps dictate the flow of crude from regions including the North Sea and West Africa turned positive for the first time since March on Monday, the latest sign that crude’s recovery isn’t just financial-driven.

“The prospect of OPEC+ advancing its meeting and agreeing an extension rather than tapering of the deeper cuts should support crude’s rally this week,” said Vandana Hari, founder of energy consultancy Vanda Insights.

An earlier OPEC+ meeting would give the producer group more flexibility to change its current production limits as members usually decide their plans for shipping oil for July in the first week of June. The group’s preference is to take short-term measures on cuts as the situation is changing quickly, the delegate said. The coalition – which includes OPEC’s 13 members plus another 10 exporters — has achieved 92% compliance, according to an estimate by data analytics firm Kpler.

| Prices: |

|---|

|

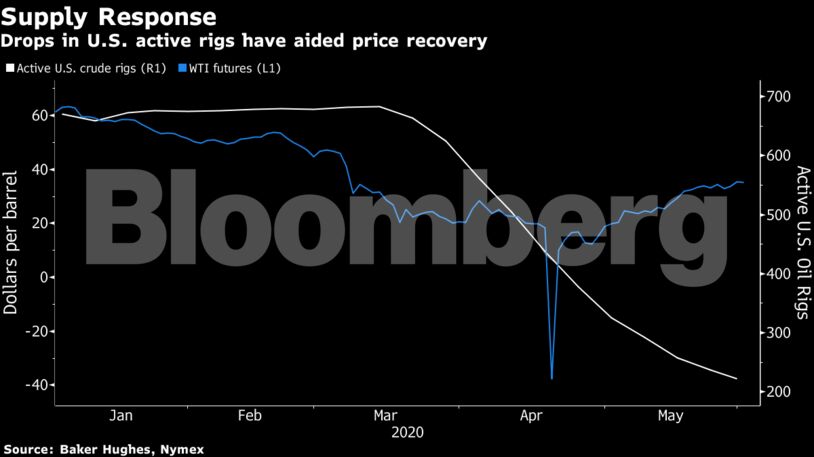

Though crude has rallied there is still evidence of a supply response in the world’s biggest oil producer — America. The number of rigs drilling for oil in the U.S. dropped for an 11th consecutive week to the lowest since 2009, according to data from Baker Hughes. Still, there’s a risk that oil’s continued advance could tempt some producers to turn their taps back on again.

Meanwhile, the U.S. Oil Fund ETF will begin its monthly roll of futures contracts on Monday. The fund plans to sell its July holdings and buy more November and January futures over the next 10 trading sessions.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Canada’s Advantage as the World’s Demand for Plastic Continues to Grow