By Elizabeth Low and Grant Smith

The Trump administration’s willingness to revive the economy comes after the disintegration of OPEC+ and subsequent plunge in oil prices threatened the U.S. shale industry and spurred an indiscriminate sell-off in markets already reeling from the coronavirus. However, investor hopes were tempered when the president didn’t appear at a White House briefing Tuesday after promising a day earlier he’d hold a news conference to announce a major stimulus.

“I view the string of announcements from Saudi Arabia as upping the ante in the poker game that the kingdom is playing with Russia,” said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas SA. “The Saudi end-goal, in our view, is to demonstrate that a cooperative solution seeking price stability is the best outcome rather the pursuit of market share.”

Brent crude for May settlement fell $1.26 cents to $35.96 a barrel on the London-based ICE Futures Europe exchange as of 10:30 a.m. in London. It jumped 8.3% Tuesday following a 24% plunge the day before.

West Texas Intermediate crude for April delivery dropped 2.9% to $33.36 a barrel on the New York Mercantile Exchange after swinging between a gain of 5.8% and a loss of 3.7%. It rallied 10.4% in the previous session after collapsing by almost 25% on Monday.

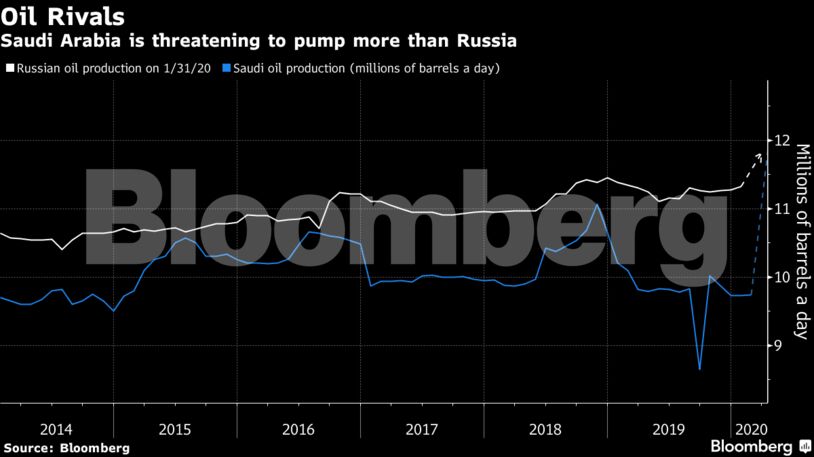

Trump spoke with Mohammed bin Salman by phone before the Saudi crown prince escalated the oil-price war Tuesday, according to two people familiar with the call. Russia’s top producer Rosneft PJSC is also planning to ramp up output in April, a person close to the company said. Iraq and Nigeria followed in their wake and said they would increase crude shipments next month.

Meanwhile, the American Petroleum Institute reported that U.S. inventories increased by 6.41 million barrels last week, according to people familiar with the data, highlighting the lack of demand. That would be the seventh straight weekly expansion if confirmed by Energy Information Administration figures due later on Wednesday.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Canada’s Advantage as the World’s Demand for Plastic Continues to Grow