By Aoyon Ashraf

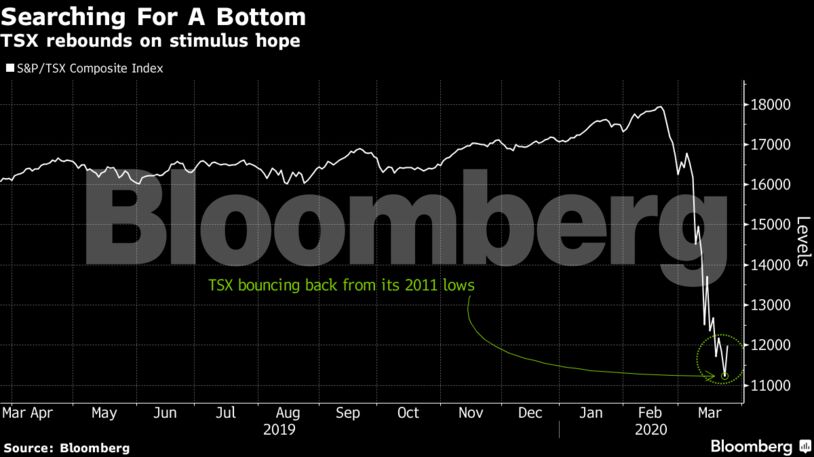

South of the border, U.S. stocks jumped more than 5% as Congress appeared close to a deal on an unprecedented spending bill to prop up the slumping economy.

The stimulus provided by governments is helping investor sentiment toward gold and its closest cousin, silver. Gold was up about 3% and silver more than 4% on Tuesday morning, giving a boost to mining stocks. The spending package by the U.S. government caused Goldman Sachs to predict an “inflection point” for gold and the bank is recommending its clients buy now.

The rally comes in the midst of moves by governments to shut down much of Canada’s economic heartland in an effort to slow down the coronavirus outbreak. Ontario and Quebec, which together account for about 57% of the country’s economy, have ordered non-essential businesses to close by the end of the day today.

Within the energy patch, Canada’s largest oil and gas company, Suncor Energy Inc., said it would cut its capital program this year by 26% as it tries to outlast the plunge in crude prices. Suncor’s cuts follow $4.4 billion in reductions already announced by other Canadian energy companies. Crude oil was up slightly.

Bombardier Inc. said it will suspend all non-essential work at most Canadian-based operations tonight until April 26 to comply with government mandates to help slow the spread of Covid-19.

Stocks

- First Quantum Minerals Ltd. climbed 27% on the base metal rally and the company’s report that it will maintain its production guidance for the year

- Chorus Aviation Inc. surged 21%

- Pembina Pipeline Corp. rose about 20%

- Cameco fell slightly after halting its Cigar Lake mine

- Real estate sector rose 8.4% after falling 15% yesterday. Notable movers include Summit Industrial Income REIT and Brookfield Property Partners LP

Commodities

- Western Canada Select crude oil traded at a $14.50 discount to West Texas Intermediate

- Spot gold rose 2.8% to $1,596.67 an ounce

FX/Bonds

- The Canadian dollar rose 0.2% to C$1.4466 per U.S. dollar

- The 10-year government bond yield rose 8.1 basis points to 0.857%

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Canadians Should Decide What to do With Their Money – Not Politicians and Bureaucrats