By Michael Bellusci

Oil’s spectacular collapse deepened, with West Texas Intermediate crude futures tumbling more than 10% in New York on demand headwinds. Gold, coming off the biggest weekly drop in almost four decades, extended losses to fall below $1,500 an ounce as market sentiment soured even after further emergency moves by the Federal Reserve.

The Bank of Canada will likely take the overnight rate to 0.25% from 0.75% ahead of the next scheduled decision on April 15, according economists from Bloomberg Intelligence.

Given the extent of pandemic-driven unknowns, the central bank may want to pull a page from the Fed’s emergency playbook and jettison the forecasting exercise over the near term.

Andrew Husby, Bloomberg Economics

“We continue to recommend investors refrain from buying the dips, and carrying above-average exposure to gold equities, even amid recent weakness in the commodity,” Canadian Imperial Bank of Commerce portfolio strategists including Ian de Verteuil wrote in a note to clients early Monday.

CIBC is among banks calling for a recession this year domestically along with in the United States. Royal Bank of Canada thinks the country will fall into a recession this year after taking a double hit from falling oil prices and the global impact of coronavirus on economic activity. Meanwhile, Bank of America said Friday Canada will experience negative GDP growth during the second and third quarters of this year.

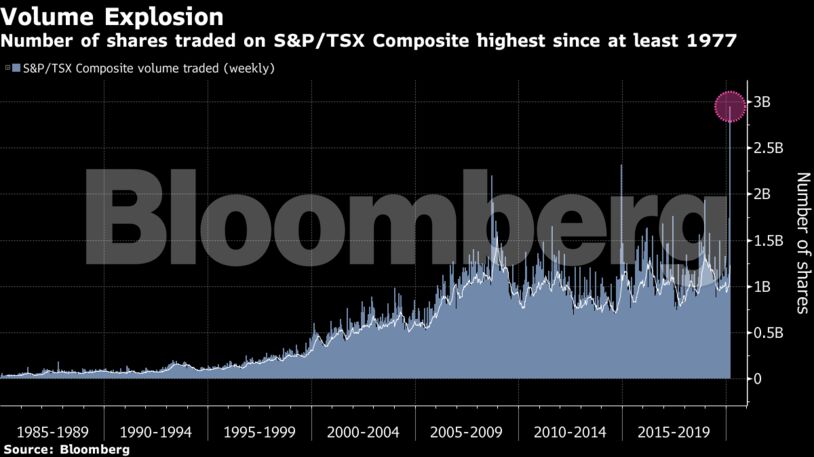

The numbers of shares traded on the benchmark S&P/TSX hit its highest level since at least 1985, when Bloomberg started compiling data.

Cineplex Inc. was down 34% as of 10:26 a.m. after an activist urged rejection of the proposed takeover offer from Cineworld Group Plc. Great Canadian Gaming Corp. fell 22% after announcing a temporary suspension of gaming facilities in Ontario, British Columbia, Nova Scotia and New Brunswick.

Energy producer Vermilion Energy Inc. fell about 20% after reducing its capital budget, while further trimming its monthly dividend.

Commodities

- Western Canada Select crude oil traded at a $16.75 discount to West Texas Intermediate

- Spot gold dropped 3.8% to $1,470.81 an ounce

FX/Bonds

- The Canadian dollar weakened 1% to C$1.3959 per U.S. dollar

- The 10-year government bond yield fell 16 basis point to 0.689%

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS