By Saket Sundria and Grant Smith

Prices also weakened in tandem with base metals and global equities following a series of negative developments in Hong Kong and worries about a deadly virus in China.

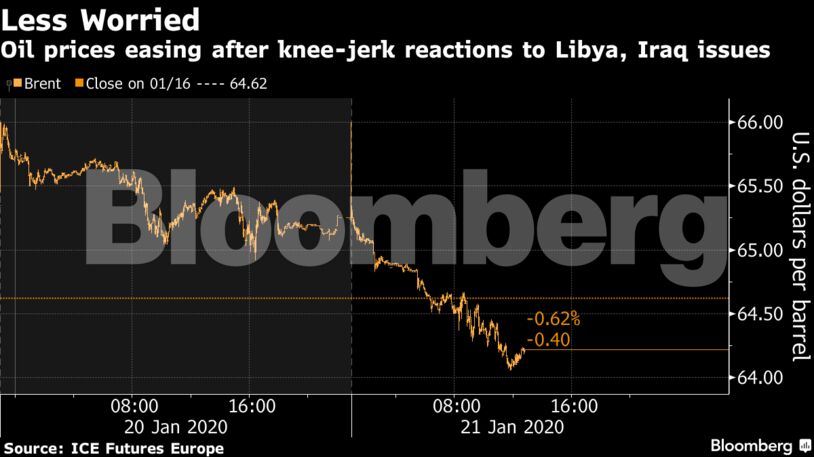

Brent crude for March settlement dropped $1.01, or 1.6%, to $64.19 a barrel on the ICE Futures Europe exchange as of 1:11 p.m. in London. West Texas Intermediate futures for February lost 84 cents from Friday’s close to $57.70. There was no settlement Monday due to the Martin Luther King Jr. holiday.

Haftar has blocked ports under his control in a show of defiance after world leaders failed to persuade him to sign a peace deal ending the country’s civil war. In Iraq, protests have halted a minor oil field and rockets reportedly hit the Green Zone in Baghdad after a weekend of unrest.

It’s the third time in four months that a supply crisis in OPEC nations has been largely shrugged off. Brent soared to almost $72 a barrel two weeks ago as hostilities between the U.S. and Iran erupted in neighboring Iraq over the assassination of an Iranian general, endangering regional energy exports, yet prices soon eased off as a wider conflict was averted.

“It would have to be a very substantial disruption to push prices above $70 a barrel on a sustainable basis,” Jeff Currie, head of commodities research at Goldman Sachs Group Inc., said in a Bloomberg TV interview. “The U.S. is still sitting on an enormous amount of inventory.”

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS