By Elizabeth Low and Grant Smith

“The signing of the U.S.-China trade deal has given optimism for a revival in global manufacturing, and thus stronger oil demand growth, and this is what gives the oil price some vigor,” said Bjarne Schieldrop, Oslo-based chief commodities analyst at SEB AB.

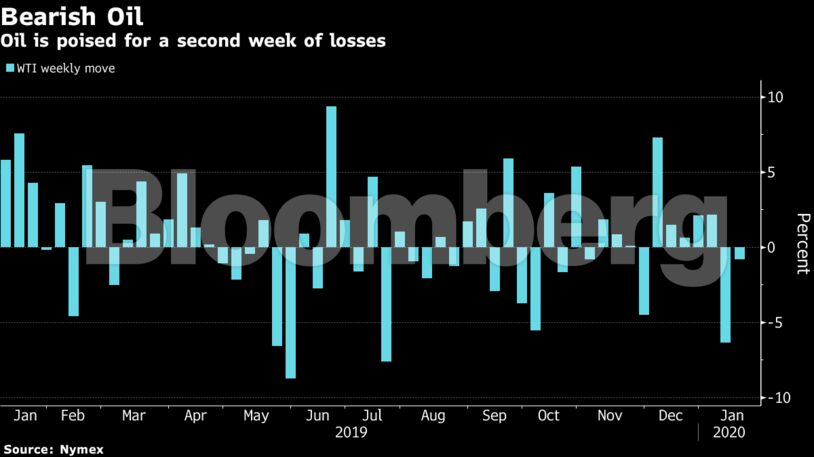

Nonetheless, West Texas Intermediate futures have lost 0.4% this week, heading for the first back-to-back weekly drop since October. The February contract added 27 cents to $58.79 a barrel on the New York Mercantile Exchange as of 10:57 a.m. London time.

Brent for March settlement rose 38 cents to $65 on the ICE Futures Europe exchange in London after climbing 1% on Thursday. That put the premium over WTI for the same month at $6.17 a barrel.

The International Energy Agency noted on Thursday that global markets have a “solid base” of inventories and climbing supplies from outside the OPEC cartel, even as elevated tensions in the Middle East endanger production from Iraq and elsewhere. A big jump in American oil-product stockpiles last week underscored that the shale boom continues.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Canadians Should Decide What to do With Their Money – Not Politicians and Bureaucrats