By Elizabeth Low and Grant Smith

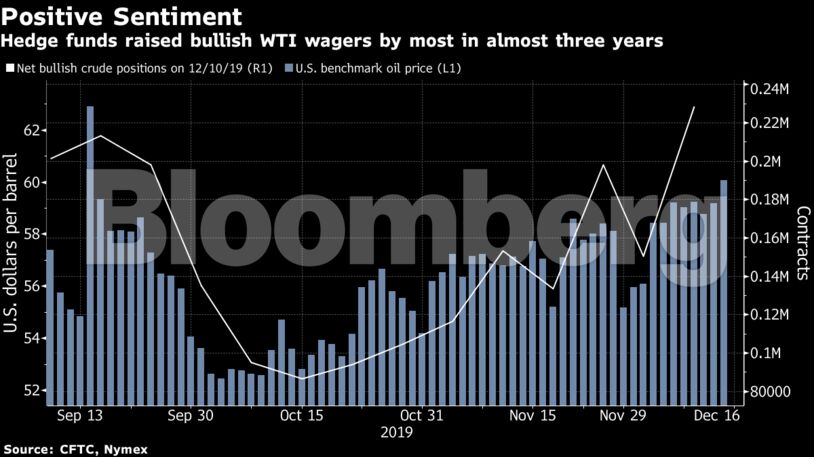

While the partial trade deal leaves most of the tariffs built up over the 20-month conflict in place, it’s adding to a more positive outlook for oil prices, which were already drawing support from deeper-than-expected production cuts announced this month by OPEC and its partners. Hedge funds increased net-bullish wagers on West Texas Intermediate crude by the most in three years in the week through Dec. 10.

“Buoyancy is being generated by optimism about the economy, rising stock markets worldwide in view of the Phase-1 deal in the trade dispute, and a weak U.S. dollar,” said Eugen Weinberg, head of commodities research at Commerzbank AG in Frankfurt.

See also: OPEC+ Deal Isn’t Worth the Paper It’s Written On: Julian Lee

WTI for January delivery was little changed at $60.05 a barrel on the New York Mercantile Exchange as of 10:22 a.m. London time. It rose 89 cents to $60.07 on Friday, taking its weekly gain to 1.5%.

Brent for February settlement was also little changed, trading at $65.25 a barrel on the London-based ICE Futures Europe Exchange after rising 1.6% on Friday and 1.3% last week. The global benchmark was at a $5.22 premium to WTI for the same month.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Canadians Should Decide What to do With Their Money – Not Politicians and Bureaucrats