By Grant Smith, Olga Tanas and Dina Khrennikova

OPEC and its allies including Russia and Kazakhstan, collectively known as OPEC+, face a difficult choice when they meet in the Austrian capital on Dec. 5 to 6. The oil market is being pulled in different directions by powerful forces over which it has little control — U.S. President Donald Trump’s trade war with China, a predicted slowdown in the American shale boom, and conflicting signals about the overall health of the global economy.

In recent weeks, OPEC’s Secretary-General Mohammad Barkindo has taken a more optimistic line, talking of “brighter spots for the 2020 outlook” and arguing that any market weakness early in the year will be fleeting. Yet if the gloomiest forecasts for demand growth combine with a rampant expansion in non-OPEC supplies, banks including Citigroup Inc. and BNP Paribas SA say prices could slump below $50 a barrel next year.

“We need deeper cuts, I just don’t know how it will be agreed,” Warren Patterson, head of commodities strategy at ING Bank NV, said on Thursday. “The level of additional cuts over the first quarter of 2020 is just too much for members to stomach I think.”

Moscow Talks

A separate meeting on Thursday in Moscow sent similar signals that OPEC+ would stay the course. After talks with Russian Energy Minister Alexander Novak, executives from oil companies including Lukoil PJSC and Russneft PJSC said they agreed to continue the current deal without changing the terms.

“Everybody proposed we remain in the deal with the same parameters, and meet again in the end of the first quarter for further discussions,” Lukoil First Vice President Ravil Maganov told reporters after the meeting.

It’s too early to say if the accord needs to be extended beyond March, said Sergey Donskoy, a board member from Irkutsk Oil Co. LLC. “Let’s not make sharp moves,” he said.

Since OPEC+ ministers typically meet to discuss policy in December and June, market watchers expect the group to agree an extension of the current deal of at least three months beyond its March expiry. In the Bloomberg survey, 20 of the 35 respondents predicted the group will decide to prolong their existing supply limits until the middle of 2020. Eight predicted a longer extension, to either September or December.

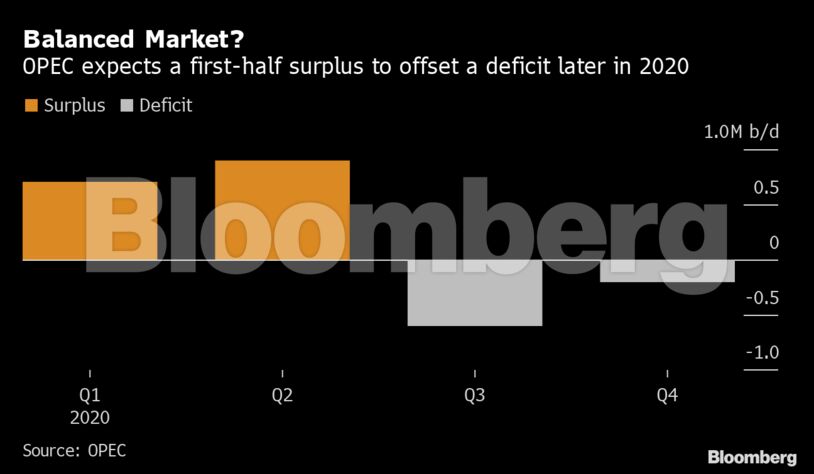

The ECB considered a number of scenarios for the oil market in 2020. The base case was for a broadly balanced market, with a gradual increase in stockpiles of 200,000 barrels a day over the course of the year, which would leave inventories in industrialized countries in line with the five-year average.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Activists Suddenly Care About LNG Investors