By Ann Koh and Grant Smith

(Bloomberg)

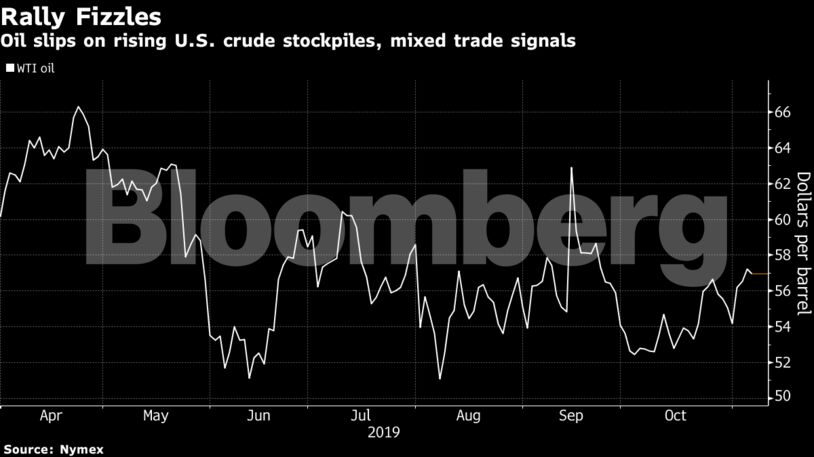

Oil retreated from a six-week high as signs of another increase in U.S. crude reaffirmed the prevailing view that global markets are comfortably supplied.

Futures lost as much as 0.8% in New York after rising 5.6% over the past three sessions. The American Petroleum Institute reported that crude stockpiles increased by 4.26 million barrels last week, according to people familiar, before official government data later on Wednesday. OPEC’s top official said on Tuesday that the market outlook for 2020 has improved, damping some speculation the group will deepen production cuts when it meets next month.

“The feel-good factor is missing this morning,” said Stephen Brennock, an analyst at PVM Oil Associates Ltd. in London. “Oil prices are taking their cues from expectations of another upswing in U.S. crude inventories.”

Oil gained earlier this week on optimism that trade tensions between the U.S. and China are easing, potentially alleviating downward pressure on the global economy and with it fuel demand. Yet prices remain about 15% below the peak reached in April amid concern that tepid consumption growth and record American shale-oil output will create a new surplus next year.

West Texas Intermediate for December delivery declined 25 cents to $56.98 a barrel on the New York Mercantile Exchange as of 10:31 a.m. in London. The contract rose 69 cents to $57.23 on Tuesday, the highest close since Sept. 24.

Brent for January settlement fell 37 cents, or 0.6%, to $62.59 a barrel on the London-based ICE Futures Europe Exchange. The contract rose 83 cents to $62.96 on Tuesday. The global benchmark traded at a $5.60 premium to WTI.

See also: End of America’s Shale Oil Boom is Nigh, Industry Pioneers Warn

Nationwide inventories are forecast to expand by 2 million barrels, according to a Bloomberg survey before Energy Information Administration data on Wednesday. The U.S. registered its first petroleum trade surplus in over four decades as production surged to a record.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Canadians Should Decide What to do With Their Money – Not Politicians and Bureaucrats