By Alex Longley

(Bloomberg)

Oil rose for a third day, buoyed by signs of progress in the prolonged U.S.-China trade dispute, despite expectations for expanding American crude stockpiles.

Futures climbed as much as 1% in New York. China is reviewing locations in the U.S. where President Xi Jinping would be willing to meet his counterpart Donald Trump to sign the first phase of a trade deal, according to people familiar with the plans, while Xi stressed his nation’s commitment to the global trading order.

Still, American crude inventories probably rose by 2 million barrels last week, according to a Bloomberg survey.

Crude is still down about 14% from a peak at the end of April as the spat between Beijing and Washington has pressured the demand-growth outlook and global supplies have swelled. China is seeking to roll back U.S. tariffs on as much as $360 billion of Chinese imports before the president agrees to signing a partial trade deal, according to people with knowledge of the matter.

“All eyes are on the U.S. to see whether the Trump administration would remove existing Chinese tariffs ahead of signing the Phase 1 trade deal,” PVM Oil Associates analyst Tamas Varga wrote in a report, adding that “the short-term direction will be partly influenced by the upcoming weekly U.S. inventory data.”

West Texas Intermediate for December delivery advanced 43 cents to $56.97 a barrel on the New York Mercantile Exchange as of 8:40 a.m. local time. Brent for January settlement rose 53 cents to $62.66 on the London-based ICE Futures Europe Exchange. The global benchmark crude traded at a $5.60 premium to WTI for the same month.

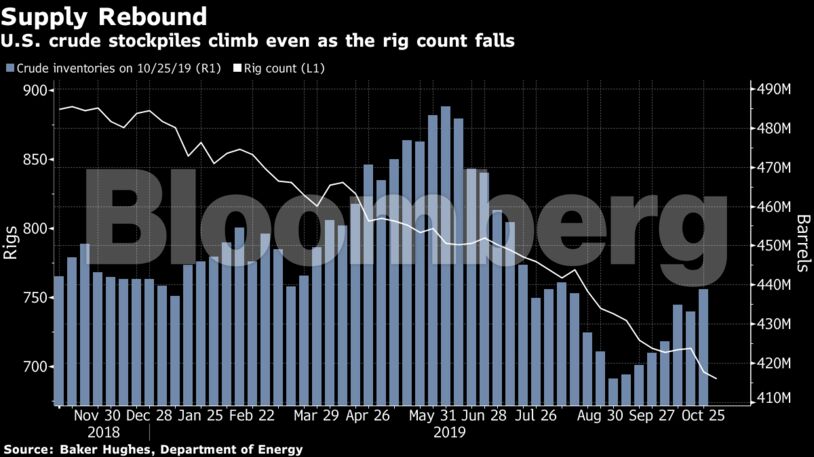

U.S. crude stockpiles probably increased for the seventh time in eight weeks through Nov. 1, even as the number of operating drill rigs dropped to the lowest level since 2017. The American Petroleum Institute will release its weekly oil-inventory report later on Tuesday.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Activists Suddenly Care About LNG Investors