By Ann Koh and Alex Longley

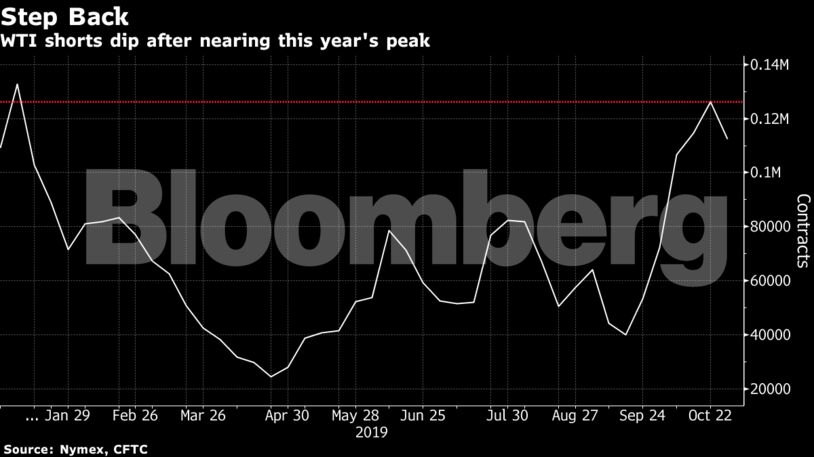

The oil market is taking heart from the signs of strength in the world’s two biggest economies as the nations move closer to a partial trade deal, despite skepticism over whether a more comprehensive agreement can be reached. Hedge funds unwound bets against American crude for the first time in six weeks, but short wagers remain almost triple what they were in mid-September, according to data released Friday.

“The market has been prepared for a bearish oil-repetition of last year, instead it is getting a bullish reverse of that,” SEB chief commodities analyst Bjarne Schieldrop wrote in a report. Bullish drivers range from PMI data to a stalling rig count and falling U.S. interest rates, he said.

West Texas Intermediate for December delivery rose 47 cents to $56.67 a barrel on the New York Mercantile Exchange as of 10:42 a.m. in London. Brent for January settlement added 56 cents to $62.25 a barrel on the London-based ICE Futures Europe Exchange, a six-week high. The global benchmark crude traded at a $5.51 premium to WTI for the same month.

Wilbur Ross said Sunday in Bangkok that the U.S. and China would likely reach a “phase one” trade agreement this month. Further phases of the deal would depend on things involving legislation on the part of China and an enforcement mechanism, he said.

Saudi Arabia is pulling out all the stops to ensure the success of Aramco’s IPO. The kingdom cut taxes on the company for a third time, revealed incentives for investors not to sell and may boost dividends further. Yet the Saudi government has already conceded the company probably isn’t worth the $2 trillion valuation Prince Mohammed has long advocated.

| Other oil market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Activists Suddenly Care About LNG Investors