By Elizabeth Low

The Organization of Petroleum Exporting Countries faces a “serious challenge” to defend oil prices next year as fuel-demand growth could slow further amid a wave of new supply from the U.S., Brazil and the North Sea, the International Energy Agency warned on Wednesday. Progress toward a limited U.S.-China trade deal, while positive, isn’t likely to have a major impact on global economic growth unless existing tariffs are rolled back.

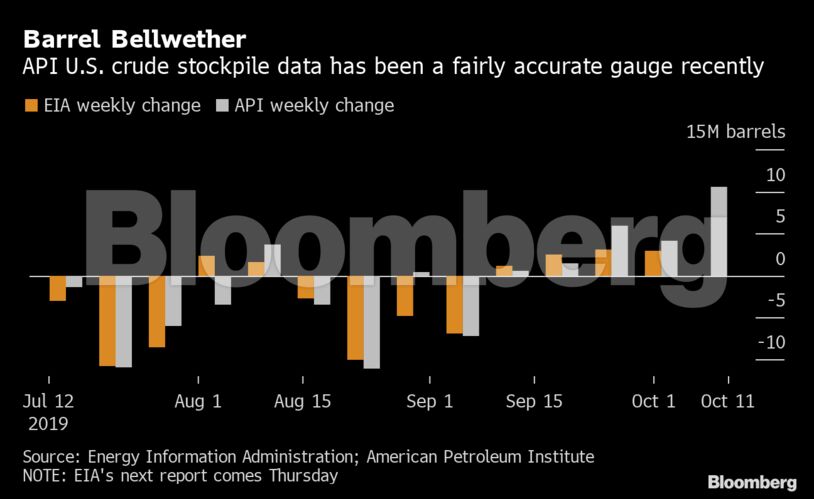

“Oil prices are facing headwinds from the unexpectedly marked 10.5 million barrel increase in U.S. crude oil stocks last week, as reported by the API after close of trading yesterday evening,” said Carsten Fritsch, an analyst at Commerzbank AG in Frankfurt.

West Texas Intermediate for November delivery dropped 10 cents, or 0.2%, to $53.26 a barrel on the New York Mercantile Exchange as of 10:43 a.m. in London. The contract added 55 cents on Wednesday, its first gain in three days.

Brent crude for December settlement was little changed at $59.42 on the London-based ICE Futures Europe Exchange. The global benchmark crude traded at a premium of $5.97 to WTI for the same month.

If the EIA data also shows an increase in U.S. stockpiles, that would be the fifth straight weekly gain, the longest run since February. American inventories probably rose by 3 million barrels last week, according to the median estimate in a Bloomberg survey.

| Other oil-market news: | |

|---|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Canada’s Advantage as the World’s Demand for Plastic Continues to Grow