By Elizabeth Low and Grant Smith “Concerns over the fallout of a negative outcome of these negotiations on the global economy and thus oil demand are running high,” said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas SA in London.

Even if the U.S. and China manage to agree on the partial deal, it’s unlikely to have a major impact on slowing economic growth as existing tariffs won’t be rolled back. The International Energy Agency last week trimmed forecasts for oil consumption for this year and 2020 amid the deteriorating economic backdrop. Disappointing economic data from Germany on Tuesday added to the concerns. West Texas Intermediate for November delivery fell $1.07, or 2%, to $52.52 a barrel on the New York Mercantile Exchange as of 10:43 a.m. in London. It dropped $1.11 on Monday, wiping out most of Friday’s $1.15 increase.

Brent crude for December settlement declined $1.24, or 2.1%, to $58.11 a barrel on the London-based ICE Futures Europe Exchange. The global benchmark crude traded at a premium of $5.51 a barrel to WTI for the same month.

“It’s clearly a market that is very macro-focused right now,” said Ole Sloth Hansen, head of commodities strategy at Saxo Bank A/S in Copenhagen. “Speculators have been quite aggressive sellers during the past couple of weeks.”

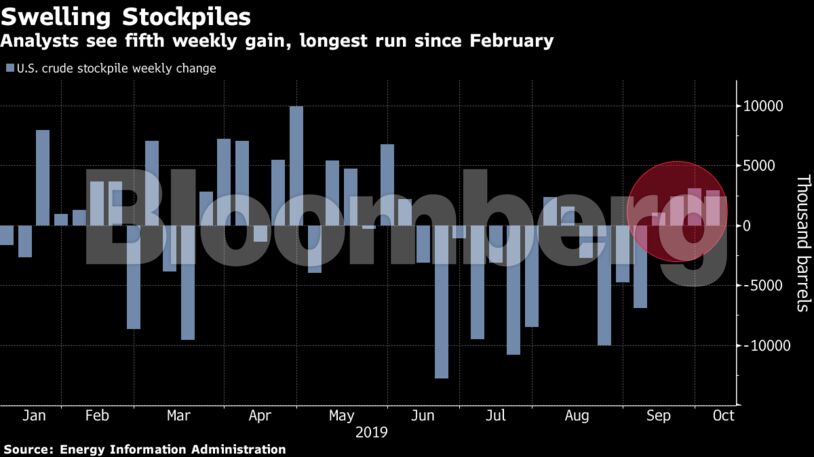

American crude stockpiles rose by 9.5 million barrels over the four weeks through Oct. 4, according to Energy Information Administration data. If they expanded again last week, that would be the longest run of gains since February.

Other oil market news

Share This:

Oil Slides Again as Economy Falters and Supplies Grow

These translations are done via Google Translate

These translations are done via Google TranslateFEATURED EVENT

GET ENERGYNOW’S DAILY EMAIL FOR FREE

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS