By Saket Sundria and Grant Smith

(Bloomberg)

Oil fell as Russia sounded a cautious note on whether OPEC and its partners may cut production further, while industry data showed U.S. crude inventories were expanding.

Futures fell as much as 1.3% in New York, erasing some of Tuesday’s gains as Russia’s Energy Minister Alexander Novak said no countries in the OPEC+ coalition had proposed changing the current level of output cuts. The American Petroleum Institute reported crude stockpiles rose by 4.45 million barrels last week, according to people familiar with the data. Official government figures are due Wednesday.

Oil has slumped about 18% from an April peak as the U.S.-China trade war dented demand and as global supplies swelled. Earlier this month, the Organization of Petroleum Exporting Countries’s Secretary-General Mohammad Barkindo said the group would do “whatever it takes” to prevent another oil slump.

“We still see a supply tsunami next year” from the U.S. and elsewhere, said Bob McNally, president of Rapidan Energy Group. “If OPEC did nothing, global inventories would rise.”

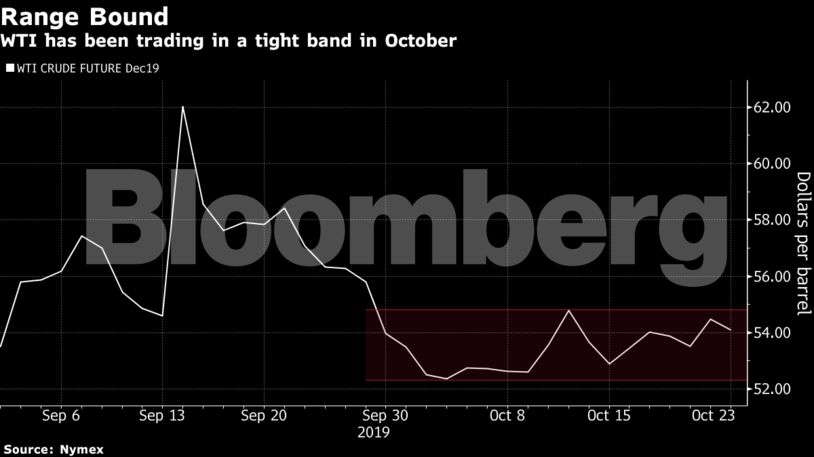

West Texas Intermediate crude for December delivery dropped 56 cents to $53.92 a barrel on the New York Mercantile Exchange as of 10:52 a.m. in London. The November contract expired Tuesday after adding 85 cents to close at $54.16, buoyed by a report that reiterated OPEC’s plans to consider extra output curbs.

Brent for December settlement fell 54 cents to $59.16 on the London-based ICE Futures Europe Exchange. The contract gained 74 cents to $59.70 on Tuesday. The global benchmark crude traded at a $5.25 premium to WTI.

See also: Saudi Aramco Pushing to Complete IPO This Year After Delay

U.S. crude stockpiles probably rose by 3 million barrels last week, according to the median estimate in a Bloomberg survey before data from the Energy Information Administration. Gasoline inventories are forecast to drop by 2.2 million barrels.

Brent crude is likely to trade around $60 a barrel in 2020 even as OPEC+ production holds around its fourth quarter level, according to Goldman Sachs Group Inc. The bank cut its global oil demand growth forecast for next year to 1.25 million barrels a day, from 1.45 million.

| Other oil market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Canadians Should Decide What to do With Their Money – Not Politicians and Bureaucrats