By Sharon Cho and Grant Smith

(Bloomberg)

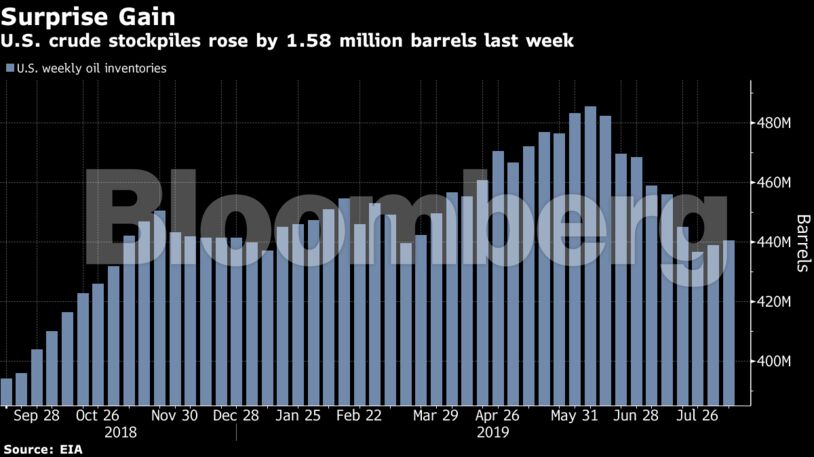

Oil held losses as a surprise gain in U.S. crude stockpiles added to deepening concerns over the outlook for global demand.

Futures fell again in New York after a 3.3% drop on Wednesday. China signaled on Thursday it may retaliate against President Donald Trump’s plans for tariffs on a further $300 billion of Chinese goods. Signs of a deeper trade war present another warning light for investors, on top of weak economic data from Germany and China and the inversion of a key part of the Treasury yield curve. Meanwhile, government data on Wednesday showed U.S. crude inventories unexpectedly swelled by 1.58 million barrels last week.

Oil is down around 7% this month as the U.S.-China trade war and near record-high American production dented the demand outlook. Crude joined a global sell-off of risk assets on Wednesday, with the 10-year Treasury yield dropping below the rate on the two-year one for the first time since 2007.

“The risk-on and risk-off signals from wider market sentiment — and not oil fundamentals — are the current driver of oil prices, so if there’s a further escalation of trade tensions there could be worse to come,” said Giovanni Staunovo, an analyst at UBS Group AG in Zurich. “Oil inventory draws have so far been limited, but we should eventually see inventories decline and help prices.”

West Texas Intermediate crude for September delivery slipped 81 cents to $54.42 a barrel on the New York Mercantile Exchange as of 10:40 a.m. in London. The contract lost $1.87 to settle at $55.23 on Wednesday, snapping a four-day gain.

Brent for October settlement declined $1.07 cents, or 1.8%, to $58.41 on the ICE Futures Europe Exchange. The contract closed 3% lower Wednesday, ending a four-day rally. The global benchmark crude traded at a $3.98 premium to WTI for the same month.

See also: U.S. Oil Hub Stockpiles Drain as WTI-Brent Spread Narrows: Chart

U.S. stockpiles posted a surprise increase for a second week, following seven straight weeks of declines. Inventories typically drop at this time of year due to the summer driving season.

A contraction in Germany’s economy and Chinese industrial output growth that trailed estimates added to concerns a global slowdown is deepening. White House Trade Adviser Peter Navarro said the U.S. can’t meet China halfway in trade talks in an interview on Fox Business Network.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS