Each week, XI Technologies scans their unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. expands on the potential for increased divestiture activity in 2019 as Canadian Juniors deal with protracted market challenges. If you’d like Wednesday Word to the Wise delivered directly to your inbox, subscribe here.

In a recent Word to the Wise article, XI looked at how corporate/asset divestitures among Juniors may be a sign of things to come in 2019 as the Canadian oil and gas industry continues to adjust to uncertain market conditions. The focus of that article was a corporate/asset divestiture announcement from Wolf Coulee Resources Inc. Lacking the critical mass to push through the current challenges, Juniors like Wolf Coulee who under other conditions would likely be going about business as usual, are being forced to contemplate a partial or full divestiture. That means some good assets, and good companies, could be up for consideration in 2019.

For the cautious money that has been sitting on the sidelines these past few years, that means 2019 may be a year of opportunity. But cautious money being well, cautious, will want to do a full analysis of the potential Asset Retirement Obligation (ARO) risks associated with any transaction. Along with pipeline capacity, responsibility for end of life costs is currently among the top two most talked-about issues in our industry. Environmental liabilities are no longer something we can deal with later. They are front and centre and they can influence deal funding. So it’s vital to have a full understanding of the ARO of an acquisition package and how that will affect your own long-term liabilities, so you can adjust your bid or merger terms appropriately.

XI has long thought that using the AER or other regulatory body’s LMR calculation to calculate the ARO for an acquisition target is faulty. We’ve discussed at length the fundamental reasons why LLR values do not result in a realistic estimate of actual ARO. You can read about the five key differences by downloading our e-paper on the subject.

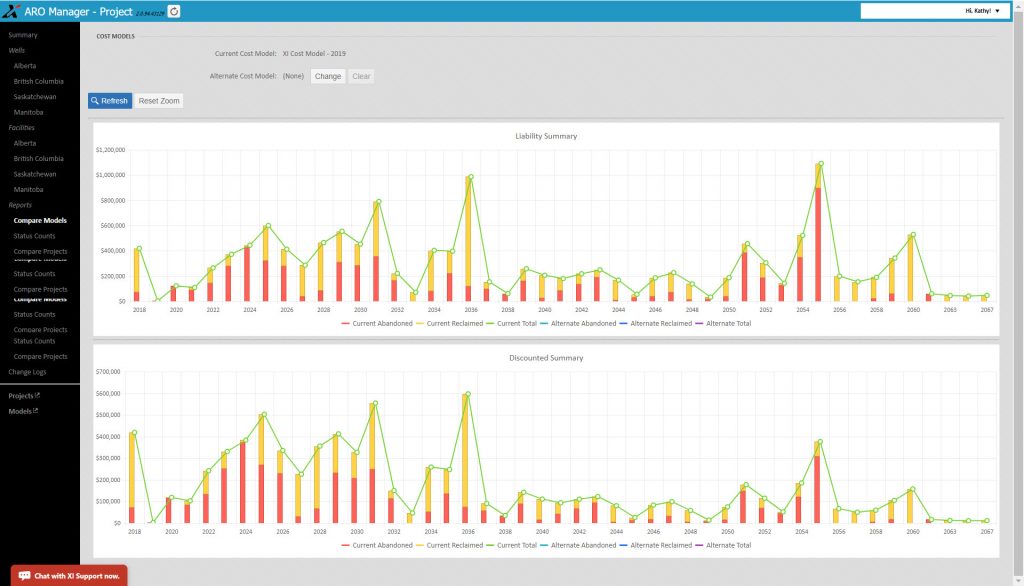

To demonstrate, let’s look at the recently announced Wolf Coulee divestiture. In Figure 1 below, we’ve run an ARO analysis on the Wolf Coulee package using XI’s ARO Manager. The ARO software calculates about a 15- to 17-per cent lower ARO obligation than what would be calculated using the AER’s LMR methodology. The primary differences come from Working Interest – because the LMR methodology applies 100 per cent liability to the operator of a project regardless of working interest ownership. This alone could represent a significant upside for you as a purchaser.

Figure 1: Wolf Coulee liability summary showing undiscounted (top) and discounted (bottom) liability aging.

When you use XI’s ARO Manager to discount the ARO over the life of the Assets, it drops that ARO obligation even further to almost 50 per cent of the undiscounted LMR obligation. With long-life assets like these, considering ARO discounting can have a significant positive impact on your decision to transact. While this example shows an improvement in ARO using XI’s ARO Manager, it’s important to note the opposite is often true as well. In those cases, the ARO Manager highlights situations where actual liabilities are likely to be higher than the LMR deemed liability calculation, allowing potential buyers to re-evaluate the economics of a purchase before they get involved.

In the current market, every producer must play the hand they’re dealt. Some players will cash out while others will decide to go all-in. Having a solid understanding of your own corporate ARO, as well as the ARO implications of every deal, could be your ace in the hole.

Want to know your company’s XI ARO number? It takes less than 5 minutes to pull a summary, and less than 30 minutes for a full analysis. Contact us.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

China’s Transition Hampered by Flat-Lining Energy Intensity