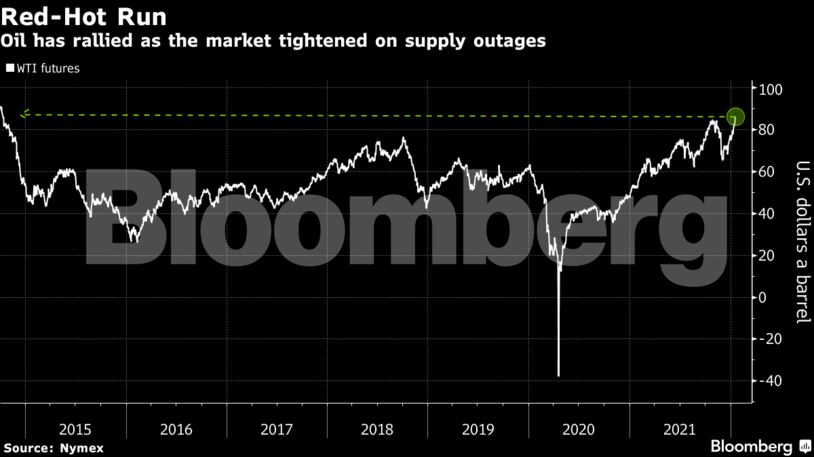

Futures in New York surpassed $87 a barrel earlier in the session after an explosion on Tuesday knocked out a key crude pipeline running from Iraq to Turkey. The disruption was short-lived however, with prices trading about 50 cents below their session high by mid-morning London time.

Oil markets have tightened in recent weeks due to stronger-than-expected demand and outages in OPEC+ producers including Libya, with buyers in Asia paying sharply higher premiums for spot cargoes. The sizzling start to the year has prompted Goldman Sachs Group Inc. to boost its forecasts for global benchmark Brent, predicting $100 oil in the third quarter. Concerns about the impact of the omicron variant of the virus have eased, global stockpiles are shrinking and unrest in the Middle East is back on the radar after a drone attack on oil facilities in the United Arab Emirates.

“Commercial oil inventories are low, oil demand could potentially rise to record levels this year, and spare production capacity is expected to fall to multiyear lows,” said Giovanni Staunovo, commodity analyst at UBS Group AG. “The market will be sensitive to any news of potential supply disruptions.”

| Prices |

|---|

|

Oil’s rally, however, poses a challenge for consuming nations and central banks as they try to stave off inflation while supporting global growth. The White House plans to continue to monitor prices and hold discussions with the Organization of Petroleum Exporting Countries and its allies as needed, a National Security Council spokeswoman said Tuesday.

See also: Key Oil Spread Jumps After Iraq Pipe Blast Buoys Prices: Chart

The IEA’s report said global oil inventories have plunged over the last 12 months. Stockpiles are down by more than a billion barrels since the peak of May 2020 and are well below pre-pandemic levels, the report said.

“Mobility and demand overall has held up relatively well,” Daniel Hynes, senior commodity strategist at Australia and New Zealand Banking Group Ltd., said in a Bloomberg Television interview. The “supply picture is looking decidedly tight and that’s going to keep those markets pretty well supported,” he added.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Activists Suddenly Care About LNG Investors